By Peter Nurse

Investing.com -- Stocks in focus in premarket trade on Thursday, November 4th. Please refresh for updates.

-

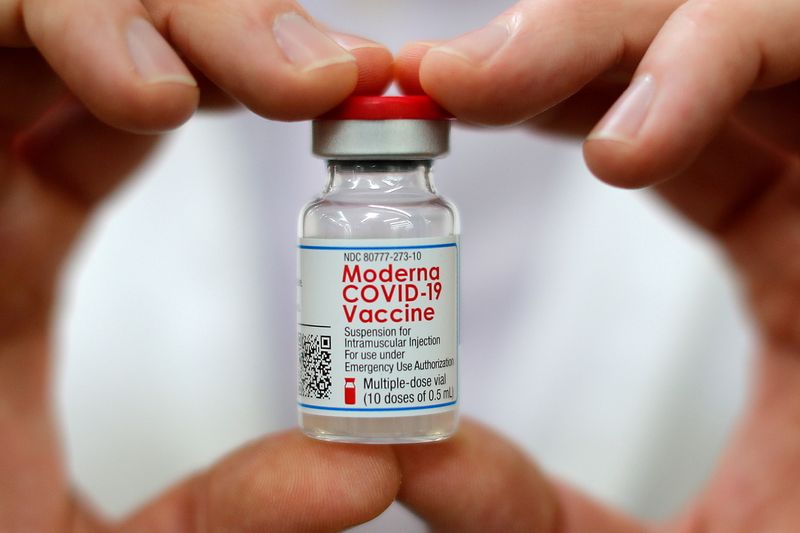

Moderna (NASDAQ:MRNA) stock slumped 11% after the vaccine maker cut its full-year sales forecast for its Covid-19 vaccine to between $15 billion and $18 billion from $20 billion, amid difficulties with the production of its two-dose inoculation.

-

Regeneron (NASDAQ:REGN) stock rose 2.4% after the biotech company reported that its third-quarter profit nearly doubled, boosted by strong sales of its drugs, including its Covid-19 antibody offering.

- IBM (NYSE:IBM) stock fell 3.6% after the tech giant completed the spin-off of its IT services section, around 25% of its overall business, in a battle to arrest a decade of decline.

-

Booking Holdings (NASDAQ:BKNG) stock rose 4.6% after the company beat third-quarter sales and profit estimates as travel rebounded during the July-September quarter.

-

Qualcomm (NASDAQ:QCOM) stock rose 9% after the chipmaker’s fourth-quarter earnings were boosted by robust demand for chips from various consumer industries. Goldman Sachs (NYSE:GS) also upgraded its stance to ‘buy’ from ‘neutral’.

-

Cigna (NYSE:CI) stock rose 1.9% after the medical insurer reported better-than-expected third-quarter profit and raised its full-year adjusted profit forecast, helped by growth in its health services unit.

-

Albemarle (NYSE:ALB) stock rose 4.5% as surging demand for lithium and specialty chemicals boosted sales and margins during the chemical manufacturer’s third quarter.

-

ViacomCBS (NASDAQ:VIAC) stock rose 0.5% after the media giant posted better-than-expected quarterly revenue, helped by more subscriber additions to its streaming platforms and strong advertising sales.

-

Merck (NYSE:MRK) stock rose 3.2% after the U.K. became the first country in the world to approve the drugmaker’s Covid-19 antiviral pill.

-

GameStop (NYSE:GME) stock fell 0.1% after the video game retailer, and former retail favorite, entered into a new $500 million global asset-based revolving credit facility with a syndicate of banks.

-

Capri Holdings (NYSE:CPRI) stock rose 5.5% after JPMorgan (NYSE:JPM) upgraded its investment stance to ‘overweight’ from ‘neutral’, saying the fashion holding company’s stock can rise another 20%.

- MGM Resorts (NYSE:MGM) stock rose 3.3% after the casino operator announced plans to sell the operations of its Mirage casino in Las Vegas to another unnamed company.