By Victoria Waldersee

STUTTGART (Reuters) -Mercedes-Benz will wait to see if EV demand picks up before adding more battery cell capacity, with lower projected EV sales meaning it will no longer need the capacity initially planned for 2030, its technology chief said on Monday.

The German automaker had said in 2022 it would need more than 200 gigawatt hours (GWh) of battery cell capacity by the end of the decade and planned to build eight cell factories worldwide with partners, including four in Europe.

But with EV demand lower than many automakers had forecast, Mercedes-Benz (OTC:MBGAF) said earlier this year it did not expect sales of electrified vehicles, including hybrids, to reach up to 50% of the total until 2030 - five years later than its previous forecast of 2025.

The 200 GWh prediction was based on the assumption that Mercedes-Benz's entire annual sales of about two million vehicles would be electric by 2030, Chief Technology Officer (CTO) Markus Schaefer said on Monday.

"Is the 200 gigawatt hour capacity still necessary? It's a question of the timeline," he said.

The carmaker signed a deal with CATL in 2022 to receive battery cells from the Chinese firm's 100 GWh plant being built in Hungary, though it did not disclose the size of the deal.

It will also receive cells from a 40 GWh plant in France via joint venture ACC, in which it holds a 30% stake. Plans to build two further ACC plants in Germany and Italy were paused last month because of low EV demand. Mercedes-Benz also has suppliers in the U.S. and China.

"We are relatively flexible. We will think about next steps when we have more transparency on demand," Schaefer said. Listing the automaker's current supplier relationships, he added: "This is enough to cover the next stage."

Mercedes-Benz has not reined in investments to electrify its product line-up and Schaefer said it was not putting significant sums into combustion engine cars beyond planned updates to bring its vehicles in line with emissions regulations.

Still, CEO Ola Kaellenius said in February the company would ensure its combustion engine line-up was competitive well into next decade to meet demand.

BATTERY TECHNOLOGY

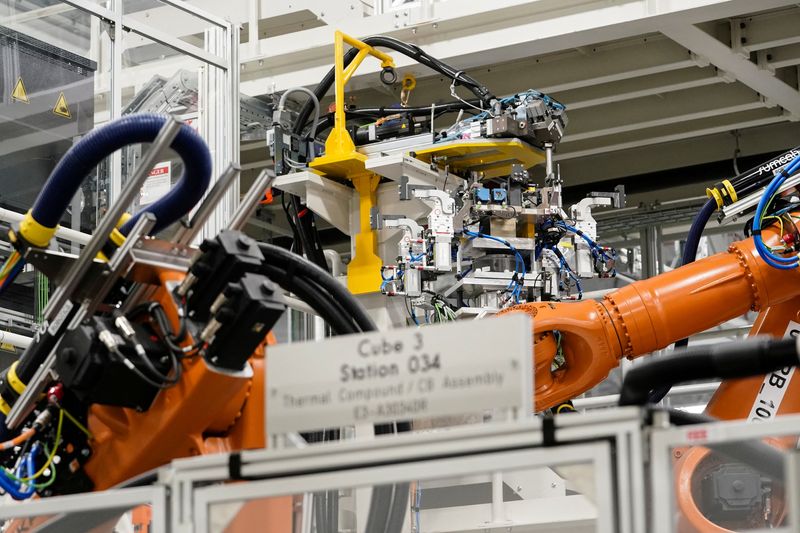

Schaefer was speaking to journalists at the inauguration of a research and production centre for battery cells at Mercedes-Benz's headquarters.

The site will produce tens of thousands of battery cells a year in a 10,000 square metre factory, as the company strives to take greater control of the chemical composition and industrial manufacturing of its batteries.

Mercedes-Benz is working on lithium ion cells with high-energy anodes and cobalt-free cathodes, as well as solid-state technology, which holds the promise of more energy storage, longer driving ranges and faster charging.

Increasing the energy density of EV batteries is key particularly for premium automakers looking to reduce vehicle weight and costs while boosting driving range.

Cell designs developed at the new centre will be shared with partner companies and incorporated into future battery cells from suppliers, Schaefer said