By Dhirendra Tripathi

Investing.com – It’s meme stocks day again. After all, it had been some time since they had a burst the same day.

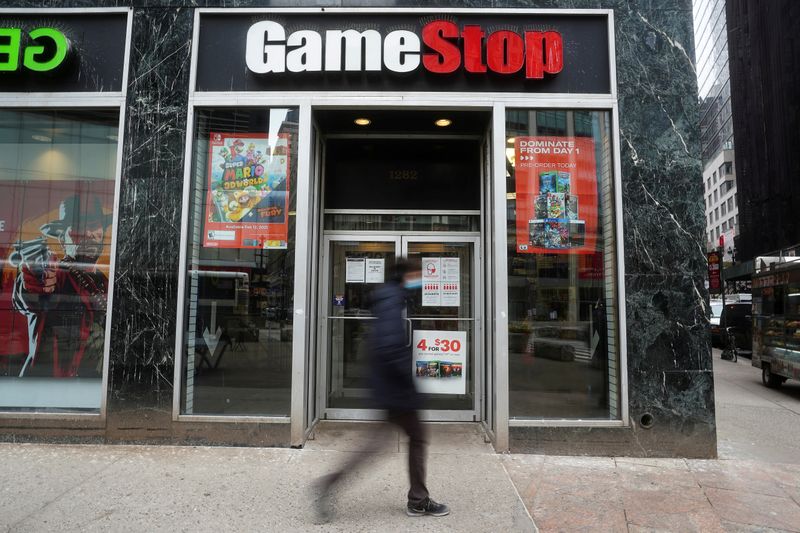

GameStop (NYSE:GME), the most favorite of the Reddit gang, and Koss (NASDAQ:KOSS) were up over 40% each while their partner in the party, AMC (NYSE:AMC), rose 22%.

Meme stocks have a cult following of their own and it all started January when a gang of Reddit followers, WallStreetBets, came together online to teach the biggies a lesson, all of whom were short on the video game retailer.

The coming together of the retail traders led to a short-squeeze and burned a hedge fund or two. But since then, the picture has gotten so murky that none knows who is the winner and who the loser. But the wild party continues, ignoring all fundamentals, be it disappointing results in case of GameStop or delayed movie releases that would hurt AMC.

Tuesday, GameStop reported earnings that came below expectations. It reported a Q4 non-GAAP EPS of $1.34 on revenue of $2.12 billion compared with consensus estimates for EPS of $1.35 on revenue of $2.21 billion.

Wedbush analysts downgraded the stock to underperform from neutral after the quarterly results, saying the short squeeze has boosted the share price to levels that are completely disconnected from the fundamentals of business.

Similarly, AMC shares were down 4% Wednesday on news that Disney would delay the release of Scarlett Johansson's Black Widow to July. Disney also said it would release the movie to at-home streaming at the same time.