By Jonathan Stempel

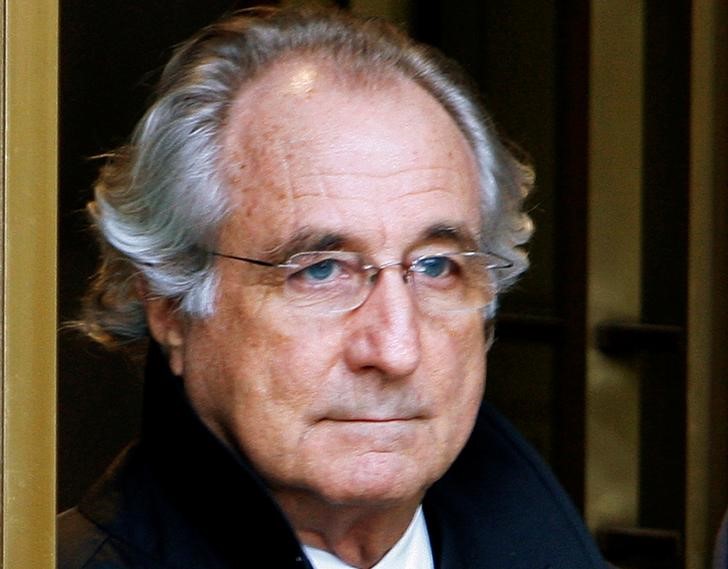

NEW YORK (Reuters) - The overseer of a $4 billion U.S. government fund to compensate victims of Bernard Madoff's Ponzi scheme expects to start distributing money this year, following criticism of the lack of payouts in the nearly four years since the fund's creation.

Money would go to 35,508 victims from 123 countries whose total losses exceeded $6.5 billion.

Their claims were deemed valid in early June by the Department of Justice, whose fund is overseen by former U.S. Securities and Exchange Commission Chairman Richard Breeden.

More than 26,000 of the 35,508 eligible victims have received nothing since Madoff's fraud was uncovered in December 2008.

Payouts could begin as soon as late October, a person close to the process said.

In an online update posted late Thursday, Breeden said about 98 percent of eligible victims invested indirectly through Madoff, such as through "feeder funds."

They have been unable to recover any funds in the liquidation of Bernard L. Madoff Investment Securities LLC, in which court-appointed trustee Irving Picard is paying only former Madoff customers. He has approved 2,612 claims.

"We are currently planning on a first distribution of cash prior to the end of this year," Breeden wrote. "We are very optimistic we will succeed."

Breeden declined to comment on Friday.

The fund was set up in November 2013, mostly with settlement money from Madoff's bank, JPMorgan Chase & Co (N:JPM), and the estate of former Madoff investor Jeffry Picower.

Criticism over the lack of payouts was fueled by published reports last month that Breeden's firm had billed the government millions of dollars for its services.

The review process took over three years, during which about 50 people, including some with bank examination experience, assessed 65,500 petitions with millions of pages of paperwork.

Hedge funds and other third parties that bought claims from victims are ineligible to recover, unlike in the Madoff firm's liquidation, in which Picard is paying on such claims.

Picard has recovered $11.6 billion and paid out more than $9 billion.

The payout process for the fund Breeden oversees came up on Tuesday when Republican Senator Richard Shelby of Alabama questioned it during a Justice Department budget hearing.

"Obviously they're not working because there are no distributions," he said.

Deputy Attorney General Rod Rosenstein replied that reimbursing victims was important, and said "we should do it as quickly as possible." He pledged to look into the matter.

"Will you get back to the committee on that?" Shelby asked.

"Yes sir," Rosenstein responded.