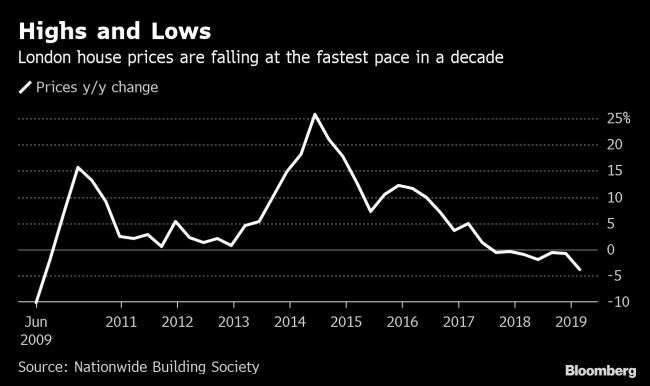

(Bloomberg) -- London continued lead the U.K.’s weakening property market at the start of 2019, with values falling the most since the financial crisis a decade ago.

Nationwide Building Society said values in the capital dropped 3.8 percent year-on-year in the first quarter. That’s a seventh straight decline and leaves London as the worst-performing region in the U.K.

Nationally, values rose 0.2 percent in March from February, according to a report on Friday. the annual rate of change improved to 0.7 percent from 0.4 percent, though Nationwide said the market remains “subdued.”

Some of weakness relates to Brexit, which is having an impact on sentiment in the market. Consumer confidence remains close to its lowest level since 2013, according to GfK.

The uncertainty over when and how the U.K. will leave the European Union has gotten worse as the government extended the deadline, having so far failed to get lawmaker approval for its exit deal. Still, a shortage of homes, record employment and low interest rates are preventing an even sharper downturn in the property market.