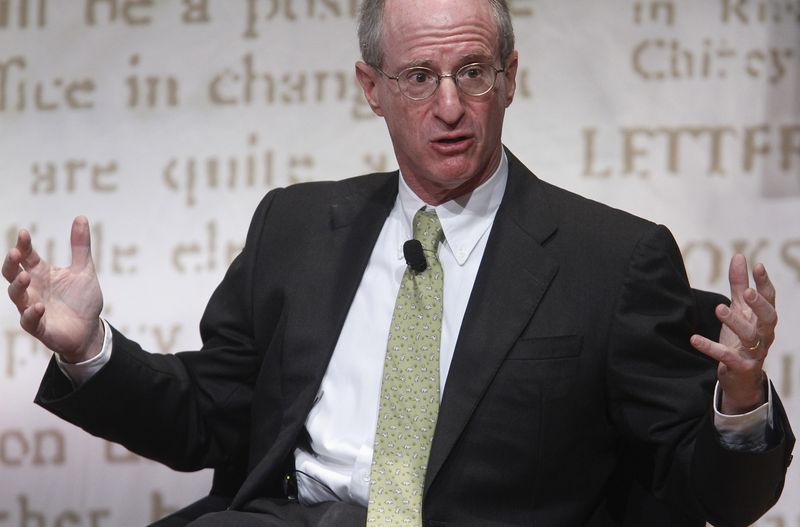

(Reuters) -Insurance firm Loews (NYSE:L)' CEO James Tisch will step down after nearly 25 years at the helm, with his son Benjamin named the successor, the company said on Monday.

The leadership of the company will remain with the influential Tisch family, know for their varied business interests and philanthropy, and after whom New York University's Tisch School of Arts is named.

James Tisch, a former board member of the Federal Reserve Bank of New York, will become the chair of Loews after retiring on Dec. 31.

His successor Benjamin Tisch, who joined Loews in 2011 as a member of its investment department, currently serves as its senior vice president, corporate development and strategy.

Both also serve on the board of CNA Financial, where Loews holds a 92% stake.

Prior to joining Loews, Benjamin was a managing director at Fortress Investment Group, where he oversaw a variety of asset classes including international fixed income and international equities for the global macro fund.

Separately, Loews reported a 2.5% jump in its second-quarter profit, helped by a rise in insurance premiums and higher returns on its investments.

Spending on insurance products by individuals and corporations has remained resilient despite economic uncertainty. A market rally on hopes of a rate cut has also benefited insurance companies' investment income.

Loews' investment income rose 8% to $639 million in the quarter ended June 30. The company earns most of its revenue from its insurance unit CNA, which fetched 6.5% higher revenue.

Profit attributable to Loews in the quarter was $369 million, or $1.67 per share, up from $360 million, or $1.58 per share, a year earlier.