(Bloomberg) -- Libya’s oil production has fallen below 1 million barrels a day for the first time in months as a budgetary dispute hinders the OPEC member’s ability to fix war-damaged infrastructure.

The National Oil Corp. stopped exports from the eastern port of Hariga, it said in a statement late Monday. The state firm said the central bank’s “refusal” to release money to the energy sector had forced local producers to pump less.

The quarrel risks derailing a recovery in Libya’s production following a truce in the nation’s civil war around mid-2020. Crude output surged from almost nothing from September and reached 1.25 million barrels a day last month, the highest level in eight years.

“The oil sector is in trouble,” the NOC said. “The national companies are suffering and groaning.”

While Libya appointed its first unity government in years last month, it remains wracked by deep political divisions and thousands of foreign mercenaries are yet to leave the country.

The NOC declared force majeure, a clause in contracts allowing exports to be suspended, at Hariga after one of its subsidiaries reduced flows to the oil terminal. Arabian Gulf Oil Co., which operates fields in the east of the country, was forced to cut production by 280,000 barrels a day, roughly 90% of what it normally pumps. The NOC didn’t say how long force majeure would be in place.

Hariga was scheduled to load six crude cargoes of 1 million barrels each next month -- equivalent to 194,000 barrels a day in total -- according to a loading program.

Other domestic producers are also struggling. Sirte Oil Co., another NOC subsidiary, has had to decrease output by about 20,000 barrels a day and more firms may follow suit, according to a person familiar with the matter.

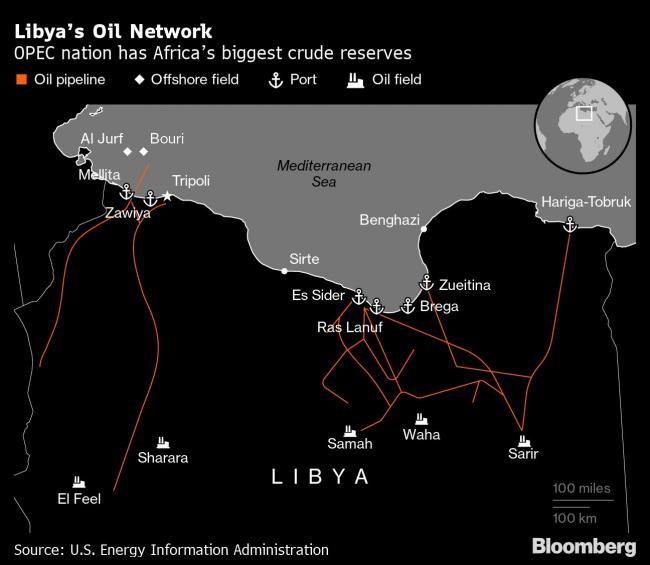

Libya, home to Africa’s largest oil reserves, has been in chaos or at war since former dictator Muammar al-Qaddafi was toppled in 2011. That’s caused its crude production to be highly volatile.

The Organization of Petroleum Exporting Countries started unprecedented production cuts last May to bolster oil prices in the face of the coronavirus pandemic. Yet Libya was exempted from a quota due to its conflict.

The NOC has long complained it needs more money to fix aging energy infrastructure. Its chairman, Mustafa Sanalla, told Bloomberg last month that daily output could rise to 1.45 million barrels this year and 1.6 million within two years if the company received adequate funds.

The NOC said in Monday’s statement that Libya’s central bank bears “full legal responsibility” for the situation after it refused to release 1 billion dinars ($222 million) that the government allocated to the sector. The NOC said it’s received less than 2% of the funds it needs this year to meet maintenance and production targets.

The unity government approved a budget last month that allotted $1.6 billion -- the biggest portion of development spending -- to the state oil company. Sanalla said he was satisfied with that sum.

©2021 Bloomberg L.P.