Investing.com -- According to Citi analysts in a note this week, China's least crowded stocks have significantly outperformed their more popular counterparts in the recent market rally.

A shift in investor sentiment, driven by a stronger-than-expected policy shift in China, has triggered a rapid reversal of underweight positions in the country, leading to notable gains in underinvested sectors and stocks, explained the bank.

Citi reports that the least crowded stocks in the MSCI China index rallied by an impressive 25%, outpacing the 15% returns of the most crowded stocks by a wide margin.

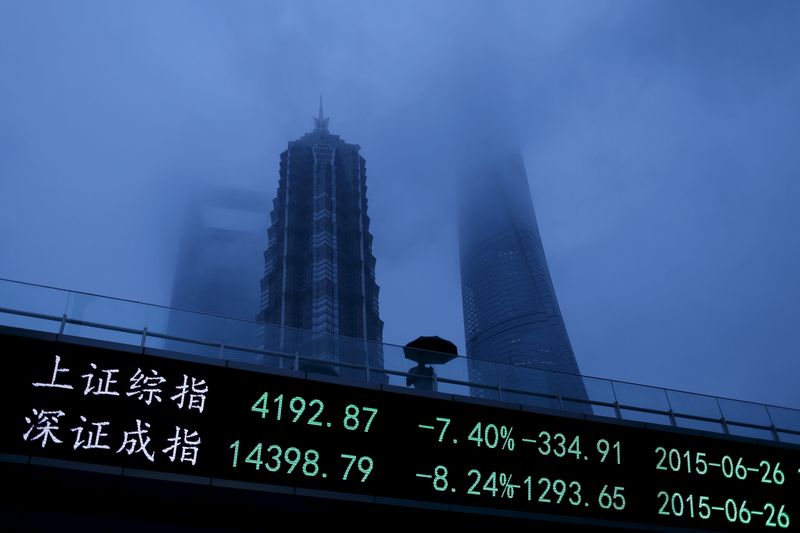

"Nearly all stocks in CSI 300 were up this week, with the index up more than 15% in the last four days and net new longs building on China A50 futures," said Citi.

The performance is said to highlight how underinvested stocks have been the biggest beneficiaries of the recent policy changes.

The reversal in sentiment is partly due to foreign investors reallocating their portfolios. Over the past year, regional investors have largely been overweight in Indian stocks while underweight in Chinese stocks said Citi.

They explained that the trend created a strong inverse relationship between foreign flows into India and China. As China's market shows signs of a rebound, Citi notes that some investors may begin taking profits from India to fund their China reallocation.

However, the bank also warns of risks in the current momentum. "Price Momentum [is] Fragile," the note says, as it identifies extreme positions in being underweight China and overweight India.

With these factors at play, investors should be cautious as momentum could be vulnerable to sudden shifts.

For investors looking to capitalize on the trend, Citi recommends screening for underinvested China stocks and DM stocks with high exposure to China to potentially capture further gains.