By Akash Sriram and Max A. Cherney

(Reuters) -Chip-making tools supplier Lam Research forecast quarterly revenue above Wall Street estimates, as semiconductor makers scramble to meet a surge in demand fueled by rising adoption of artificial intelligence (AI) technology.

Lam shares rose about 2% in extended trading.

Businesses across sectors have been racing to incorporate AI capabilities after OpenAI's ChatGPT caught the attention of consumers and investors alike, benefiting companies like Lam that are essential to the chip supply chain.

Lam Chief Executive Tim Archer said AI was in its initial stages with more investments in factories and in the company's tools as being critical over the next several years.

"Advanced AI servers have significantly higher leading-edge logic, memory and storage content versus traditional servers, and every incremental 1% penetration of AI servers and data centers is expected to drive $1 billion to $1.5 billion of additional (chip equipment) investment," Archer said on a conference call with analysts.

The company expects first-quarter revenue of $3.4 billion plus or minus $300 million, above expectations of $3.3 billion, according to IBES data from Refinitiv.

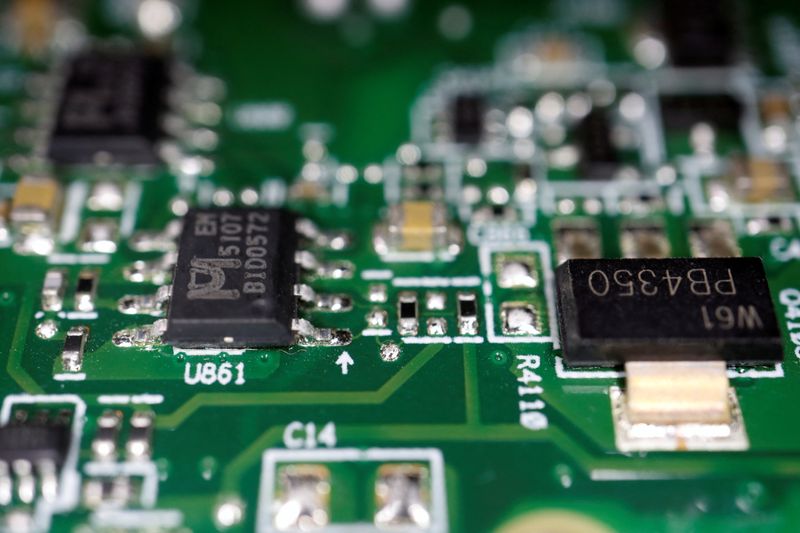

Lam, Applied Materials (NASDAQ:AMAT) and Dutch firm ASML are among a few main suppliers of wafer fabrication equipment - sophisticated and expensive machinery used to make semiconductors.

For the rest of 2023, Archer said he expects the total market for chipmaking equipment to be roughly $70 billion. It could receive a boost from demand from domestic Chinese purchases of equipment and high-speed memory tools.

Chinese companies have shifted purchasing to equipment used for older logic and memory chips following U.S. export control restrictions from October of 2022, the CEO said.

The AI boom has also helped chipmakers cushion a post-pandemic downturn in demand for personal computers and smartphones.

Lam reported fourth-quarter revenue of $3.21 billion, lower than $4.64 billion a year ago but above market expectations of $3.13 billion.

Excluding items, the company posted a profit of $5.97 per share, compared with estimates of $5.07.