(Reuters) - Chip-making tools supplier Lam Research (NASDAQ:LRCX) forecast September quarter revenue above Wall Street estimates on Wednesday, anticipating a surge in orders from chip firms amid the AI boom.

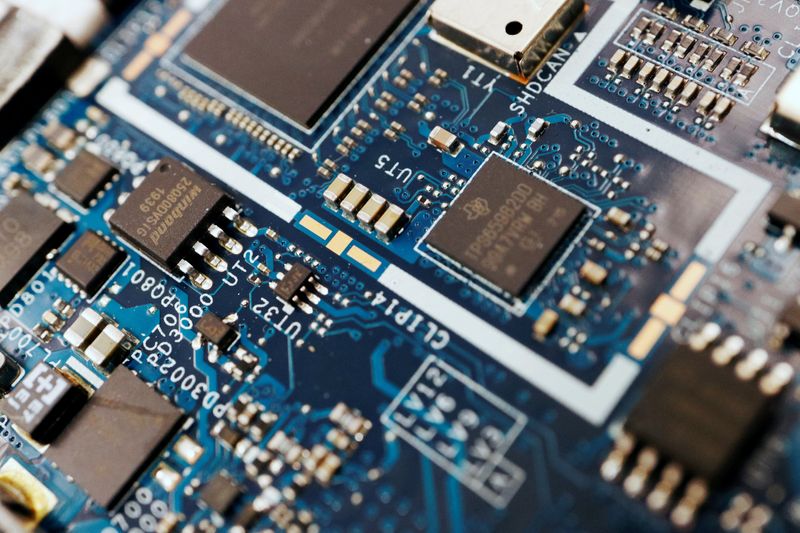

The surge in demand for AI-powered chips has increased the need for wafer fabrication equipment, sophisticated and expensive tools essential for chip manufacturing, benefiting companies like Lam Research.

The Fremont, California-based company forecast revenue for the quarter ending September 29 to be between $4.05 billion plus or minus $300 million, compared with analysts' average estimate of $4.02 billion, according to LSEG data.

Lam Research competes with other major WFE suppliers including Applied Materials (NASDAQ:AMAT), Dutch firm ASML (AS:ASML) and KLA Corp.

Last week, KLA Corp forecast revenue and profit for its fiscal first quarter above expectations after posting better-than-expected results for the preceding three months.

The rising demand for high-performance computing and data centers has also fueled the need for memory semiconductors like dynamic random access memory (DRAM) and flash memory, which has in turn benefited suppliers of chip-making tools.

Lam, which counts Intel (NASDAQ:INTC), Micron Technology (NASDAQ:MU), Samsung Electronics (KS:005930) and TSMC among its customers, forecast adjusted net income per share of $8 plus or minus $0.75 for September quarter, in line with estimates.

Revenue for the quarter ended June 30 came in at $3.87 billion, beating analysts' average estimates of $3.82 billion.

Total revenue from China was 39% in the reported quarter, down slightly from 42% in the prior quarter.

Its adjusted profit per share in the quarter was $8.14, which also came ahead of the estimates of $7.58 per share.