By Jonathan Stempel

NEW YORK (Reuters) - The U.S. Virgin Islands wants to expand its lawsuit accusing JPMorgan Chase & Co (NYSE:JPM) of aiding in Jeffrey Epstein's sex trafficking in girls and young women, adding a new obstruction charge and a claim that bank executives joked about the late financier.

In a Monday filing in Manhattan federal court, the territory said Epstein's behavior had been "so widely known" at JPMorgan, where he was a client from 2000 to 2013, that senior executives "joked about Epstein's interest in young girls."

The obstruction charge concerns JPMorgan's alleged effort to thwart enforcement of a U.S. anti-trafficking law by processing large cash withdrawals for Epstein and his associates, with the "purpose" of helping Epstein evade criminal liability.

Among the beneficiaries of Epstein's largesse was his former girlfriend Ghislaine Maxwell, who received more than $23 million from 1999 to 2002, the territory said.

JPMorgan did not immediately respond to requests for comment after market hours.

The U.S. Virgin Islands needs permission from U.S. District Judge Jed Rakoff in Manhattan to amend its complaint.

Its lawsuit seeks unspecified damages for Epstein's alleged sexual abuse of young girls and women on Little St. James, a private island he owned.

The proposed complaint refers to a recent deposition from Mary Erdoes, JPMorgan's head of asset and wealth management, in heavily redacted form.

Chief Executive Jamie Dimon is expected to be deposed in May. Neither Dimon nor Erdoes has been accused of wrongdoing.

JPMorgan is separately suing Jes Staley, its former private banking chief and later Barclays (LON:BARC) Plc's chief executive, for concealing what he knew about Epstein.

On March 20, Rakoff rejected JPMorgan's bid to dismiss lawsuits by the U.S. Virgin Islands and Epstein's accusers.

He also refused to dismiss a lawsuit by Epstein's accusers against Deutsche Bank AG (NYSE:DB), where Epstein was a client from 2013 to 2018.

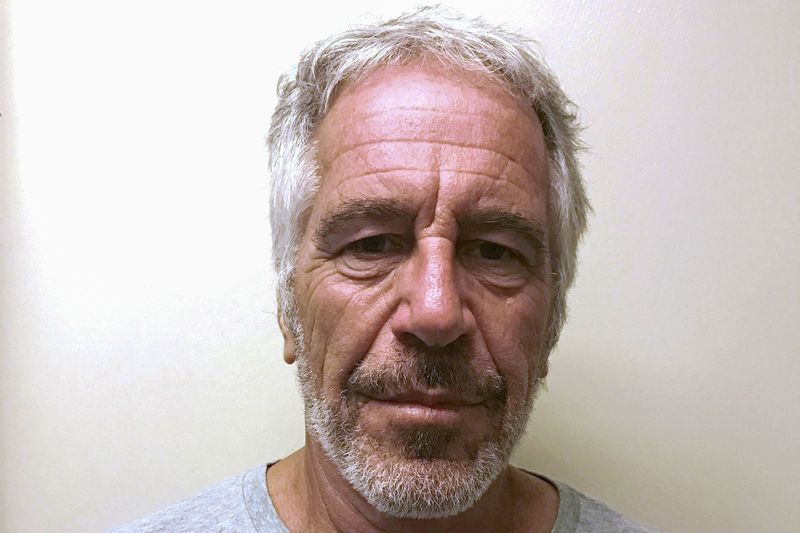

Epstein killed himself at age 66 in a Manhattan jail cell in August 2019 while awaiting trial on sex trafficking charges.

Maxwell is appealing her conviction and 20-year prison sentence, which she is serving, for aiding in Epstein's abuses.

The cases in the U.S. District Court, Southern District of New York are: Jane Doe 1 v Deutsche Bank (ETR:DBKGn) AG et al, No. 22-10018; Jane Doe 1 v JPMorgan Chase & Co, No. 22-10019; Government of the U.S. Virgin Islands v JPMorgan Chase Bank NA, No. 22-10904; and JPMorgan Chase Bank NA v Staley, in Nos. 22-10019 and 22-10904.