By Jonathan Stempel

NEW YORK (Reuters) -JPMorgan Chase & Co and Deutsche Bank AG (NYSE:DB) asked a U.S. judge to dismiss lawsuits by women who accused Jeffrey Epstein of sexual abuse, and said the banks enabled and ignored red flags about the late financier's sex trafficking.

The banks in papers filed on Friday night in Manhattan federal court said they did not participate in or benefit from sex trafficking by their former client and that the unnamed women failed to allege violations of a federal anti-trafficking law.

The banks also said they had no duty to protect the women from Epstein and did not cause his abuses, requiring the dismissal of claims under a new law in New York that lets abuse victims sue even if statutes of limitations have expired.

"Jane Doe 1 is a survivor of Epstein's sexual abuse, and she is entitled to justice," but filed meritless claims against the "wrong party," JPMorgan said in its filing.

A lawyer for the women says the facts, as described in their complaints, speak for themselves.

"We are disappointed in the banks' continuing effort to avoid taking responsibility for their role in the expansion and perpetuation of Jeffrey Epstein's sex trafficking ring," David Boies, the lawyer, said in a statement to Reuters.

Both lawsuits seek class-action status and unspecified damages. They were filed on Nov. 24 by lawyers who have represented many Epstein accusers.

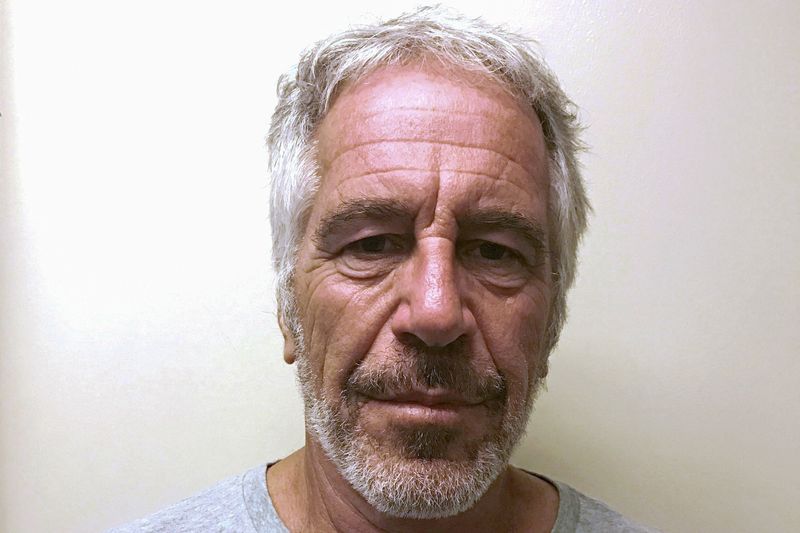

Epstein killed himself in a Manhattan jail cell in August 2019 while awaiting trial on sex trafficking charges.

Epstein was a JPMorgan client from about 2000 to 2013, and a Deutsche Bank (ETR:DBKGn) client from 2013 to 2018, court papers show.

The JPMorgan plaintiff is a former ballet dancer who said Epstein abused and trafficked her from 2006 to 2013, while the Deutsche Bank plaintiff said she suffered from similar misconduct between 2003 and 2018.

Both said numerous cash payments from the banks were used to pay Epstein's victims.

New York state's financial regulator in July 2020 fined Deutsche Bank $150 million over its relationship with Epstein.

On Tuesday, the U.S. Virgin Islands, where Epstein had a home, sued JPMorgan, saying the bank turned a "blind eye" to his trafficking while providing banking services.

The cases are Jane Doe 1 v Deutsche Bank AG et al, U.S. District Court, Southern District of New York, No. 22-10018, and Jane Doe 1 v JPMorgan Chase & Co (NYSE:JPM) in the same court, No. 22-10019.