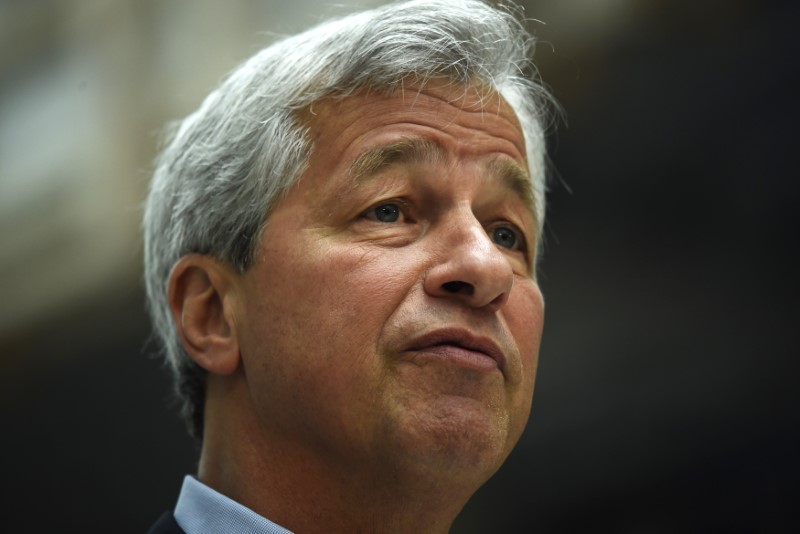

NEW YORK (Reuters) - The stock of JPMorgan Chase & Co (N:JPM) has been climbing so much that "at a certain price," the company may consider issuing a special dividend to distribute excess capital rather than buying back additional stock, Chief Executive Jamie Dimon said on Tuesday.

Dimon, speaking at an investor conference, said that if the stock is not cheap compared to its intrinsic value, he would generally rather pay out capital to existing shareholders than buy back stock from selling investors.

JPMorgan shares traded at $82.66 shortly after Dimon spoke, down 0.6 percent in morning trading. They are up this year by 25 percent, with three-fourths of that gain having come since the U.S. presidential election.

The company reported that its tangible book value per share was $51.23 at the end of September.

Dimon, who was speaking in a question-and-answer format that touched on a variety of topics, also said that fourth-quarter markets revenue is running higher than a year earlier by "15 percent-plus."

In the credit card wars being waged by banks, Dimon said JPMorgan plans to introduce more new cards after finding surprisingly strong demand for its Sapphire Reserve premium card this year. He did not say when the new cards will be offered, or how they might differ from the bank's current product line.

Dimon passed up the opportunity to make strong arguments for changes in Washington to regulations passed since the financial crisis. He did, however, recommended adjustments in the Dodd-Frank financial reform act to make rules that are more prescriptive and give regulators less discretion to set specific terms.

Repealing the so-called Volcker rule against proprietary trading would not materially impact JPMorgan's results, Dimon said.