By Svea Herbst-Bayliss, Nupur Anand and Ross Kerber

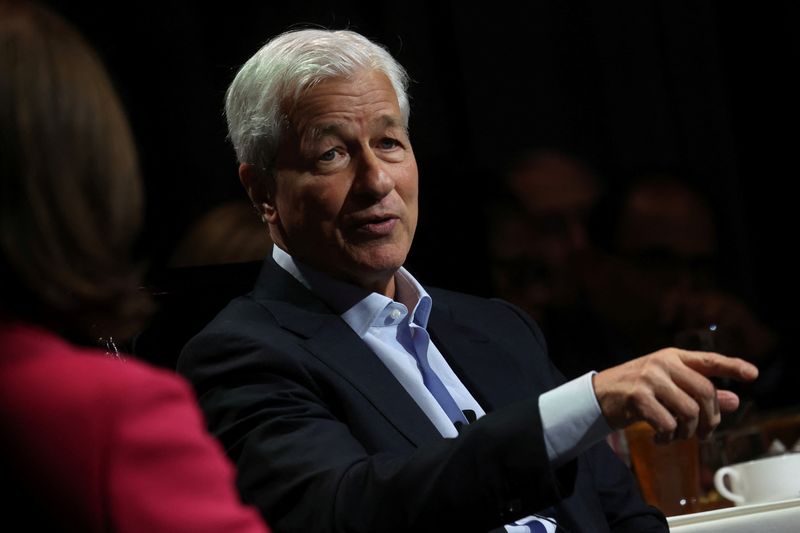

NEW YORK (Reuters) -JPMorgan Chase is focused on succession planning and has a cadre of "extremely" qualified people who are prepared to run the bank eventually, CEO Jamie Dimon said on Tuesday.

Dimon and his team spend a lot of time thinking about what happens after he retires, Dimon said, without giving a timeframe.

"We all want to get that exactly right," he told pension funds and institutional investors at a conference in New York.

Dimon has been at the helm of the largest U.S. lender since 2006. He is among a group of financial CEOs whose names have been floated for senior economic roles in government, including Treasury secretary.

Dimon previously signaled his timeline for stepping down is no longer five years and could be as soon as two-and-a-half years.

President Daniel Pinto "could run the bank tomorrow," Dimon said.

JPMorgan has identified Jennifer Piepszak and Troy Rohrbaugh who jointly lead commercial and investment banking, Marianne Lake, who runs the consumer business, and Mary Erdoes, the head of asset and wealth management, as potential successors.

Dimon also touched on hot-button issues for investors.

Annual shareholder meetings are a waste of time, especially for companies that spend time addressing investor concerns and questions in regulatory filings, he said.

Dimon also weighed in on how corporate boards are structured. Chair titles should be scrapped, because lead directors have comparable importance and play a similar role in terms of convening board meetings and setting agendas, he said.

Some investors have argued that combined chair and CEO roles, which Dimon holds, could give some executives too much power.