TOKYO (Reuters) -Japanese trading house Sumitomo Corp reported net profit for the fiscal year ended in March fell 31.7% from a year earlier to 386.4 billion yen ($2.5 billion), missing estimates, as it took a one-time loss on four businesses.

A LSEG poll of analysts had forecast Sumitomo's net profit for the fiscal year at 504.9 billion yen.

Sumitomo booked a total of 150 billion yen one-off losses on four problematic operations, including the Ambatovy nickel project in Madagascar, which wiped off nearly a half, or 89 billion yen, from its bottom line.

"We will consider all possible options to decide the best future policy of the Ambatovy project for all stakeholders," CEO Shingo Ueno, who took office on April 1, told a briefing on Thursday.

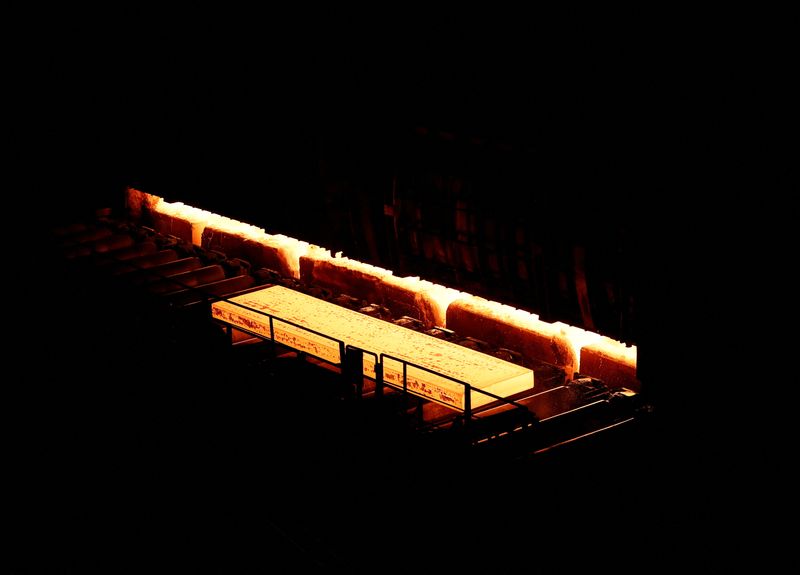

Asked whether an withdrawal was among the options, Ueno said Sumitomo's immediate priority is to bring back nickel production to normal levels by fixing glitches at the plant.

"After that, we must consider all options, taking into account our economic and social responsibilities," he said, adding that no further loss is expected from the project as it has impaired virtually all of its book value.

Sumitomo, which has been struggling to stabilise production and improve profitability at the Ambatovy, in February cut its nickel output estimate at the project.

It launched the Ambatovy project in 2005 and expects it to produce 35,000 metric tons of nickel this fiscal year.

For the year ending in March 2025, it forecast a net profit of 530 billion yen, supported by the strong performance of chemical and mineral resources business.

It also made public a three-year management plan starting in April, including a target of boosting its net profit to 650 billion yen in the year ending March 2027 and achieving a total shareholder return ratio of 40% or more.

($1 = 155.8700 yen)