By Tim Kelly and Miho Uranaka

TOKYO (Reuters) -Japan said on Friday it will restrict exports of 23 types of semiconductor manufacturing equipment, aligning its technology trade controls with a U.S. push to curb China's ability to make advanced chips.

Japan, home to major chip equipment makers such as Nikon (OTC:NINOY) Corp and Tokyo Electron Ltd, did not specify China as the target of the restrictions, saying manufacturers would need to seek export permission for all regions.

"We are fulfilling our responsibility as a technological nation to contribute to international peace and stability," Minister for Economy, Trade and Industry Yasutoshi Nishimura told a news conference.

Japan wants to stop its advanced technology being used for military purposes and does not have a specific country in mind, he said.

But the decision, coming ahead of a weekend visit to Beijing by Japanese Minister for Foreign Affairs Yoshimasa Hayashi, will be seen as a major win for the U.S., which in October announced sweeping restrictions on access to chipmaking technology to slow China's technological and military advances.

"Politicising, instrumentalising and weaponising economic and technological issues, and artificially disrupting the stability of global production and supply chains will only harm others and harm themselves," Chinese foreign ministry spokesperson Mao Ning said at a briefing when asked about Japan's new export rules.

The U.S. needs the cooperation of industry heavyweights Japan and the Netherlands for its measures to be effective and to ensure its companies do not face a competitive disadvantage.

Those two countries in January agreed to join the U.S. in restricting exports to China of equipment that could be used to manufacture sub-14 nanometre chips, but did not announce the pact to avoid provoking China, sources previously told Reuters.

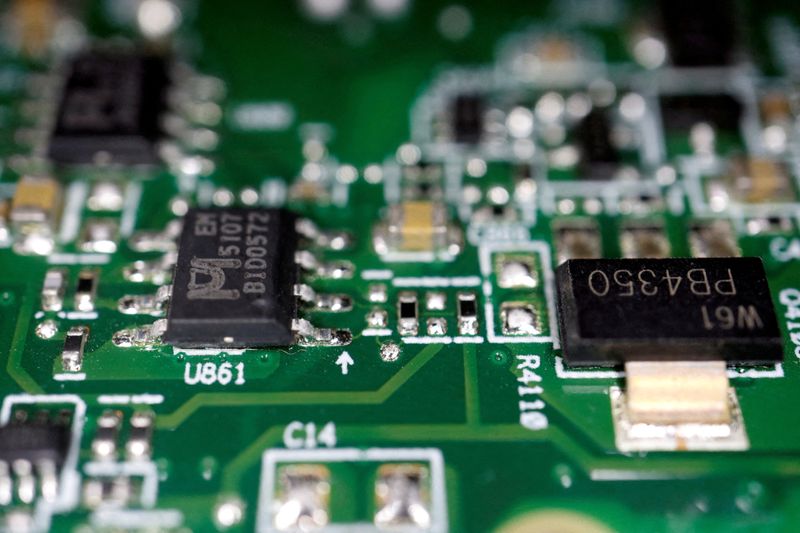

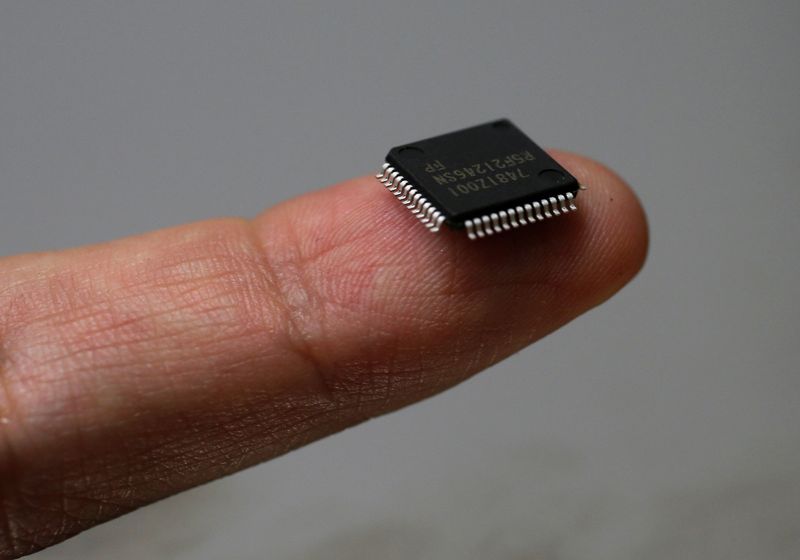

A nanometre, or one-billionth of a metre, refers to a semiconductor industry technology, with fewer nanometres generally meaning more advanced chips.

The Netherlands this month said it planned to restrict the export of chipmaking equipment, such as from ASML Holding (NASDAQ:ASML) NV which dominates the market for lithography systems used to create chips' minute circuitry.

China has accused the U.S. of being a "tech hegemony" and urged the Netherlands not to follow it.

IMPACT

Effective July, Japan will impose export controls on six categories of equipment used in chip manufacturing, including cleaning, deposition, lithography and etching.

Chinese firms "will lose access to more products from Japanese companies that produce chipmaking equipment. Chinese fabs (chip plants) are mostly focused on mature nodes by now, which this isn't supposed to effect, but we'll have to see how this plays out," said Stew Randall, who tracks China's chip sector at Shanghai-based consultancy Intralink.

The controls are likely to affect equipment made by at least a dozen companies, such as Screen Holdings Co Ltd and Advantest Corp, though minister Nishimura - without elaborating - said he expected limited impact on domestic firms.

A Nikon spokesperson said sales of two of its lithography machines will likely be affected though the earnings impact was unclear.

"We will continue to comply with any rules and work to maximize our results within them," the spokesperson said.

Tokyo Electron, Advantest and Screen also said they will follow the new export restrictions, but did not say what impact the control could have on their businesses.

The curbs will be a blow for Japanese equipment makers given the absence of a strong domestic chip market, said Takamoto Suzuki, head of economic research for Marubeni in China.

"It will undermine the market development of Japanese companies and certainly reduce their competitiveness from a regulatory aspect," Suzuki said.

Japan once dominated chip production but has seen its market share slip to about 10%. Still, it remains a major supplier of chipmaking machines and semiconductor materials. Tokyo Electron and Screen make around a fifth of the world's chipmaking tools, while Shin-Etsu Chemical Co Ltd and Sumco (OTC:SUOPY) Corp produce most silicone wafers.

"If you take a long-term view, the effect will be diminished, with new semiconductor plants coming into operation in places like the United States and Japan," said Takahiro Shinada, a professor at Tohoku University.

Following the announcement, Nikon's share price rose 0.9%, in line with the wider market, while Advantest finished up 2.4%. Tokyo Electron and Screen were little changed from the previous day.