By Scott Murdoch and Matt Scuffham

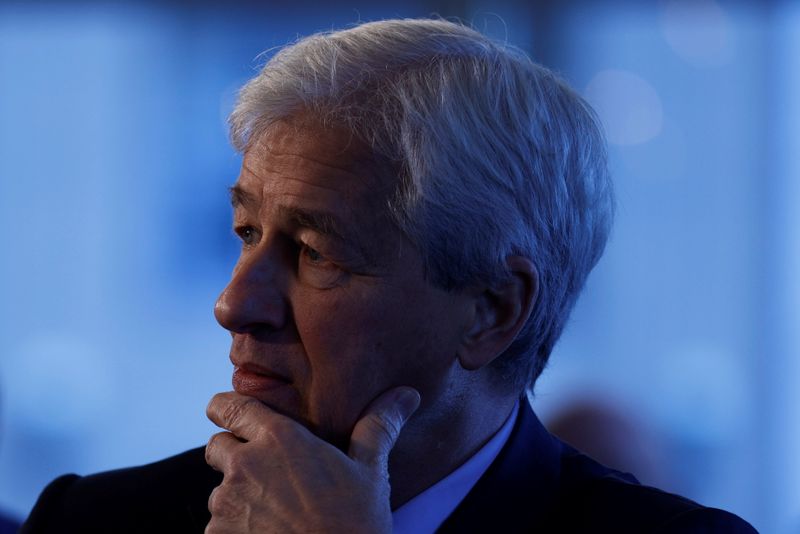

HONG KONG/NEW YORK (Reuters) -JPMorgan Chase Chief Executive Jamie Dimon said on Wednesday he regretted his remarks that the Wall Street bank would last longer than China's Communist Party (CPC), moving quickly to avoid any longer-term fallout.

Dimon's comments had risked jeopardizing JPMorgan (NYSE:JPM)'s growth ambitions in China where it won regulatory approval in August to become the first full foreign owner of a securities brokerage in the country.

China experts in the United States said his quick apology should ensure no serious damage was done.

"I regret and should not have made that comment. I was trying to emphasize the strength and longevity of our company," Dimon said in a statement issued by the bank.

Dimon realized immediately after he made the comment that it was a mistake, according to a source familiar with his thinking. After seeing the reaction, he decided to express regret, the source said.

In a later statement, Dimon said: "It's never right to joke about or denigrate any group of people, whether it's a country, its leadership, or any part of a society and culture. Speaking in that way can take away from constructive and thoughtful dialogue in society, which is needed now more than ever."

Referring to the matter in a comment posted on Twitter (NYSE:TWTR) on Thursday, the outspoken editor of nationalistic tabloid Global Times, Hu Xijin, said: "You don't have to regret actually.

"The CPC has succeeded in its sphere far more than JP Morgan's. As a member of the CPC, I don't mind your company riding the wave of CPC's popularity."

A day earlier, Hu said: "Think long-term! And I bet the CPC will outlast the USA."

Speaking at a Boston College series of CEO interviews on Tuesday, Dimon said: "I made a joke the other day that the Communist Party is celebrating its 100th year - so is JPMorgan. I'd make a bet that we last longer."

"I can't say that in China. They are probably listening anyway," he added.

Beijing's approval for JPMorgan to take full ownership of its securities business was a milestone in the opening of China's capital markets after years of gradual moves and pressure from Washington.

Beijing sees the involvement of foreign banks as important for China's domestic financial development, academics say. However, they add, Western companies doing business in China still need to tread carefully.

"Dimon's apology shows the degree of deference foreign businesses have to show to the Chinese government in order to remain in its good graces and maintain access to the country’s markets," said Eswar Prasad, a professor at Cornell University.

"I don't think this will have any longer term consequences," said Leland Miller, chief executive at data firm China Beige Book and an expert on China's financial system.

Asked by Bloomberg about Dimon's comments at a news conference on Wednesday, Chinese foreign ministry spokesman Zhao Lijian replied: "Why the publicity stunt with some grandstanding remarks?," according to an English language transcript of the remarks https://www.fmprc.gov.cn/mfa_eng/xwfw_665399/s2510_665401/2511_665403/t1919627.shtml.

BACKLASH

Global executives typically choose their words carefully when discussing China, where foreign companies have occasionally been subject to backlash for perceived offenses.

Swiss bank UBS ran into trouble in 2019, after a remark by one of its senior economists about food inflation and swine fever was interpreted as a racist slur. He was suspended for three months and UBS lost a plum role on a bond deal for a state-backed client.

Earlier this year, Swedish fashion giant H&M's and U.S.-based Nike Inc (NYSE:NKE) faced a backlash from Chinese state media and ecommerce platforms after expressing concern about allegations forced labour had been used to produce cotton in Xinjiang.

"The Chinese government has amply demonstrated its willingness to curb or in some cases shut down foreign businesses' operations in the country if they challenge the government openly or even engage in perceived or indirect slights," said Cornell's Prasad.

A week ago Dimon was granted an exemption by the Hong Kong government to visit the Chinese-controlled financial hub without needing to quarantine.

Visitors to the city from most countries must stay in hotel quarantine for two to three weeks at their own cost.

Dimon was in Hong Kong for 32 hours after arriving by private jet.

"Jamie Dimon's best and worst trait is that he speaks his mind," said Wells Fargo (NYSE:WFC) analyst Mike Mayo.

"It typically works well for him and makes him more authentic and appreciated by investors. But sometimes it gets him into trouble."