By Akash Sriram, Harshita Mary Varghese and Joey Roulette

(Reuters) -Shares of moon lander maker Intuitive Machines tumbled 30% in extended trade, wiping out a Friday rally after the company said its spacecraft had tipped over shortly after touching down on the lunar surface a day earlier. The stock of the first private company to successfully land on the moon nearly doubled from $4.98 before the Feb. 15 launch to $9.59 as of Friday's close. Friday's late-day sell-off left it below $7.

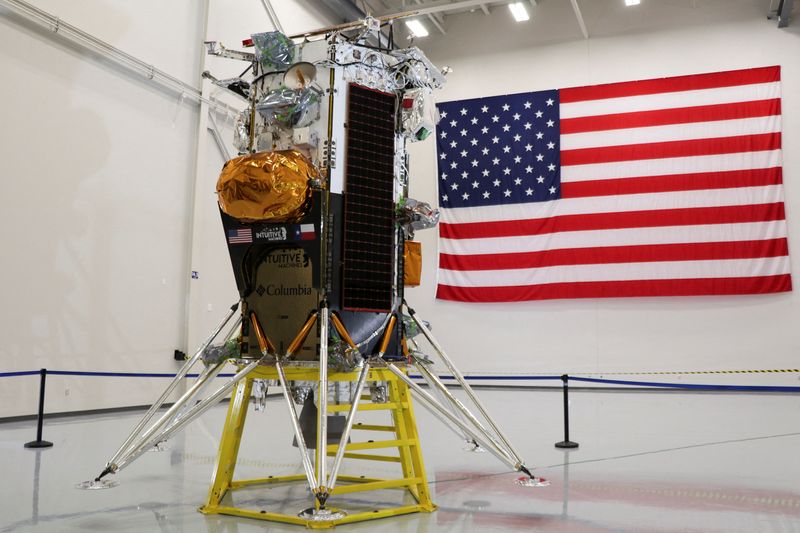

Still, the company said the spacecraft Odysseus is "alive and well" and engineers were sending commands to the vehicle, and NASA officials at a news conference praised the effort.

The first touchdown on the lunar surface by a U.S. spacecraft in more than half a century enthused investors of fellow space startups, sending up shares of companies such as Astra Space and Satellogic. They slipped between 0.5% and 2.8% in after-hours trading.

Stephen Altemus, CEO of Houston-based Intuitive Machines, which built and flew the lander, said the vehicle is believed to have caught one of its six landing feet on the lunar surface during its final descent and tipped over, coming to rest on its side propped up on a rock.

He said teams were working to obtain the first photo images from the lunar surface at the landing site.

Company executives said all of the lander's active payloads - all payloads but one, an art piece - were facing upwards and expected to carry out their scientific objectives.

Andres Sheppard, senior analyst at Cantor Fitzgerald, which was an investment banking partner for Intuitive Machines, before the news of the tip-over had described the landing as a major achievement that should boost awareness and credibility for the entire space industry and new companies.

Enthusiasm on Friday had pushed Intuitive Machines' stock market value near $1 billion.

However, just 18% of the company's shares are available for trading on the stock market, with most of Intuitive Machines' stock held by insiders and major investors, according to LSEG data. That makes the over-$850 million worth of the company's shares exchanged on Friday a massive turnover for a single session.

The Texas-based company's lunar lander touched down at the Malapert A crater, about 300 km (190 miles) from the moon's south pole on Thursday.

It was sent to the moon last Thursday using a Falcon 9 rocket launched by Elon Musk's SpaceX from NASA's Kennedy Space Center in Cape Canaveral, Florida.

The company, co-founded in 2013 by serial space industry investor Kam Ghaffarian and NASA veterans Altemus and Tim Crain, is awaiting first images from the lunar surface.

The landing could open the doors to investments and government contracts, helping space companies ride out what has been a tough period of funding due to an uncertain economy.

EXCLUSIVE CLUB

The landing represented the first controlled descent to the lunar surface by a U.S. spacecraft since Apollo 17 in 1972, when NASA's last crewed mission docked on the moon with astronauts Gene Cernan and Harrison Schmitt.

Intuitive Machines spent roughly $100 million developing its Odysseus lander, CEO Altemus told Reuters last year.

"We had to build an entire lunar program, not just a lander," he said at the time.

The company's lander development also had $118 million in NASA funds under the agency's Commercial Lunar Payload Services (CLPS) program, an effort to spur private development of moon landers that can ship cargo at lower costs than the U.S. space agency's traditional method of building and launching those lunar vehicles itself.

"We think we can meet all the needs of the commercial payloads," Altemus said at the briefing on Friday.

Privately held Astrobotic made the first moonshot attempt under the CLPS program last month but a propulsion leak doomed the mission. Texas-based Firefly Space, backed by private equity firm AE Industrial Partners, is expected to send its Blue Ghost lander to the moon later this year.

Ghaffarian, who is also the co-founder of Axiom Space, is on the board of other space organizations and has held numerous technical and management positions at Lockheed Martin (NYSE:LMT), Ford (NYSE:F) Aerospace and Loral.

CEO Altemus joined NASA's Kennedy Space Center and the shuttle program in 1989, where he held several positions working in launch and landing activities.