By Stefanno Sulaiman

JAKARTA (Reuters) - Indonesia's transport ministry and three consultants have pushed back on a China-funded consortium's plan to start full commercial operations of the country's $7.3 billion first high-speed train service in August, an internal document shows.

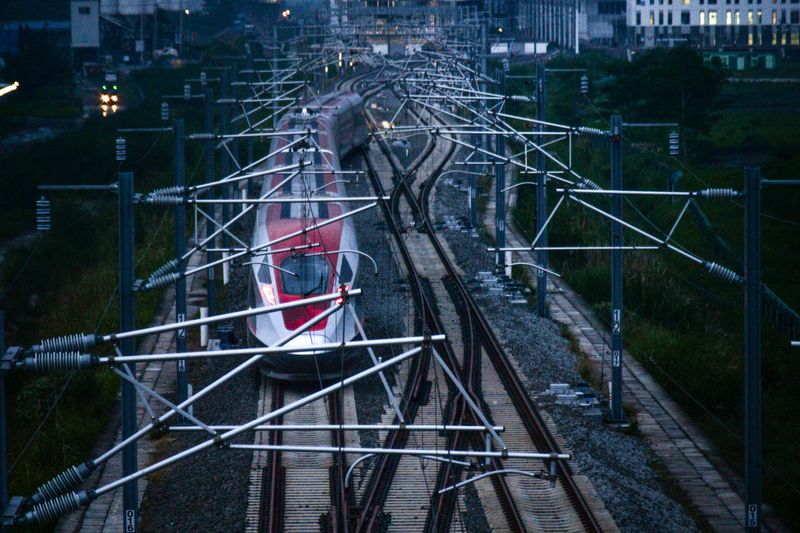

A flagship project of President Joko Widodo - and part of China's Belt and Road Initiative (BRI) - the 142 km (88 miles) line from capital Jakarta to the large city of Bandung being built by a consortium of Indonesian and Chinese state firms is already $1.2 billion over the initial budget and four years behind schedule.

A smooth opening of the railway line, the most high-profile BRI project in Southeast Asia's largest economy, as part of Independence Day celebrations would be a shot in the arm for its ruling party ahead of a general election next year, analysts said.

"A further delay will only become ammunition for the opposition to attack," said Teuku Rezasyah, an international relations analyst at Padjadjaran University, adding that setbacks would taint China's credibility to develop and deliver big projects in the region.

Months before its proposed commercial launch in August, the showpiece project is beset by fresh problems, with the consortium's Chinese participants wanting a full operational worthiness certificate for the line despite an incomplete station, a 48-page presentation reviewed by Reuters shows.

Instead, the transport ministry and consultants Mott MacDonald, PwC and local law firm Umbra have suggested that full-fledged commercial operations could start in January 2024, the "Progress Update" report dated May 14 shows.

"There is a risk that the target of commercial operations in August could be delayed to complete all construction by December 31," said the report, written in the local language.

Financial restructuring at PT Wijaya Karya Tbk (WIKA) - an Indonesian state-owned construction firm with an indirect minority stake in the consortium - is also hitting the working capital needs of the project, which has already accumulated at least $381.75 million in outstanding payments, another internal document shows.

WIKA corporate secretary Mahendra Vijaya said the company had the financial capacity to finish the remaining work, but it also needed the consortium to pay it for work already done.

Indonesia is negotiating with China on an additional $560 million loan and asking for an interest rate of 2.8% for the portion of the loan in yuan, which is lower than the China Development Bank (CDB) offer of 3.46%, according to a second set of documents dated May 18.

The possibility of a further delay and other details in the two documents have not been previously reported.

Septian Hario Seto, a senior official with the investment coordinating ministry, said debt negotiations were underway with CDB, focused on the interest rate.

The railway plans to begin a free trial with passengers in mid-August, with paid trips expected in September and the incomplete station likely finished by November, he added.

PwC declined to comment. China-backed consortium PT KCIC, Mott MacDonald, Umbra, CDB and China's embassy in Jakarta did not respond immediately to requests for comment.

DELAYS AND DOUBTS

The fresh loan is needed to help cover a $1.2 billion cost overrun.

PT KCIC was awarded the project in 2015 after lodging a cheaper proposal than a Japanese rival, with completion expected in 2019. But the project has been plagued by delays due to land ownership disputes, questions over its economic impact and the COVID-19 pandemic.

Delays and cost blowouts are not uncommon in high-speed rail projects globally, including in Western countries.

PT KCIC expects it will take 40 years for its investment to become profitable, twice as long as initial estimates, an executive said last year.

One-way tickets on the line will cost up to 350,000 rupiah ($23.56) depending on the distance travelled, according to PT KCIC, nearly a quarter of the average Indonesian's weekly income.

The planned 45-minute train ride between Jakarta and Bandung compares with a car journey of two to three hours or the current three-hour rail trip.

But with the terminal stations located outside the city centres, the high-speed rail line could struggle to attract the business passengers being targeted, said Sutanto Soehodho, a transportation analyst at the University of Indonesia.

"They value time and seek convenience," he said. "But if they need to transit again, why should they use it?"

Locating the stations in central Jakarta and Bandung would have been too costly, ministry official Seto said.

($1 = 14,855.0000 rupiah)