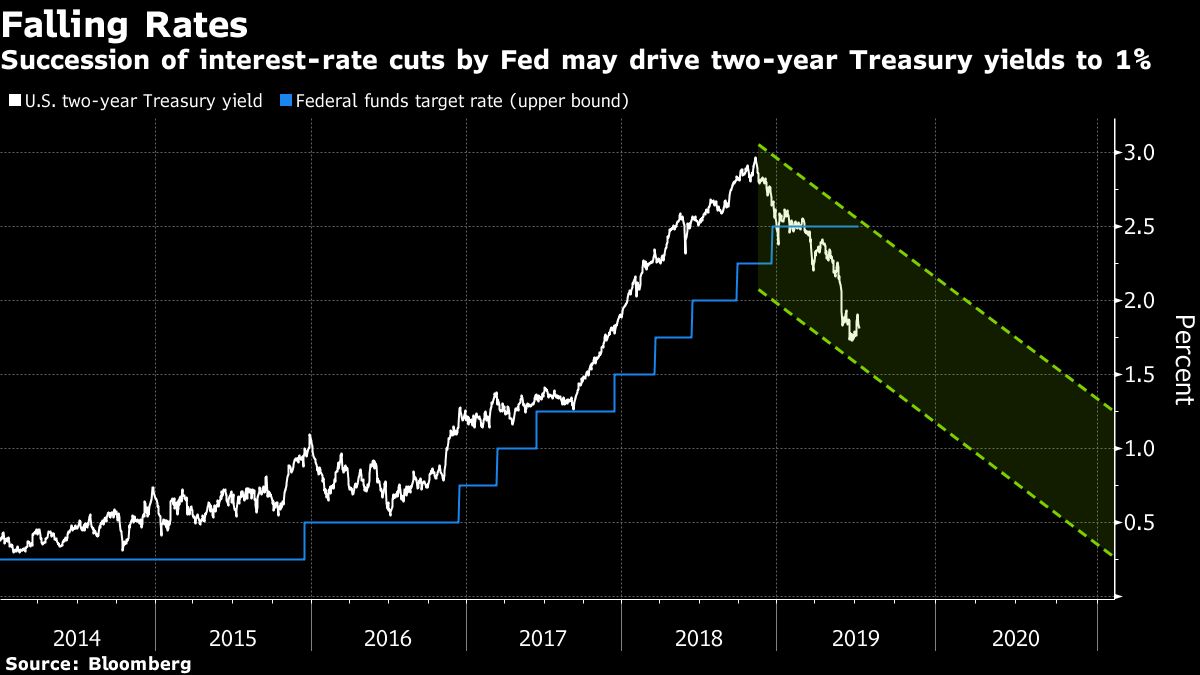

(Bloomberg) -- Treasury two-year yields may slide to 1% by the end of 2020 as the Federal Reserve makes a succession of interest-rate cuts to support growth, Citigroup Inc (NYSE:C). says. The dollar is set to slide in that scenario, according to Pacific Investment Management Co.

“We’re at a point where we’re weighing whether the Fed will cut for insurance or if they’re entering a period of structural, cyclical downturn in interest rates -- I’m leaning more towards the latter,” said Shyam Devani, senior technical strategist at Citigroup in Singapore. “I wouldn’t be surprised if we see two-year yields dropping to 1% by the end of next year.”

Citi is forecasting the Fed will lower its benchmark rate by 25 basis points this month and potentially cut another two times by year-end. “Inflation expectations remain low, we have a global slowdown in growth and commodity prices remain weak,” he said. “The Fed could cut well into next year.”

Traders are pricing in about 75 basis points of easing by year-end after Chairman Jerome Powell’s dovish testimony to Congress on Wednesday, when he cited slowing global expansion and trade tensions as threats to the U.S. economy. The Treasury two-year yield was three basis points lower at 1.80% in London trading after sliding eight basis points on Wednesday.

Pimco’s View

Whether the dollar is poised for a prolonged decline depends on how the central bank positions its July move -- especially if it’s the beginning of a cycle, said Erin Browne, a managing director and portfolio manager at Pimco in Newport Beach, California.

“What really matters is, is this an insurance cut or a sustained move lower?” she said in a Bloomberg Television interview on Wednesday. “If it’s a sustained move lower, I think the curve steepens fairly significantly from here and we could start to see the dollar really roll over.”

The dollar would be particularly vulnerable against the euro and potentially the yen should the Fed embark on a series of rate cuts, Browne said. The Bloomberg Dollar Spot Index fell 0.2% on Thursday, extending its decline to 1.6% from this year’s high set in May.

Powell’s remarks not only failed to push back against the rate cut that’s fully priced in for July, they boosted the rate-cut narrative, Andrew Hollenhorst, chief U.S. economist at Citigroup in New York, wrote in a research note.

A 50 basis-point cut in July is a real possibility, though a 25 basis-point move is likely to be the compromise policy outcome, he said.

Here’s what other market participants are saying:

Dollar Catalyst ( BNP Paribas (PA:BNPP))

Powell’s testimony “is a good potential catalyst for a resumption of the USD weakness we saw last month,” analysts including Shahid Ladha said

Flatter Curve (DBS Bank)

Treasury yield curve may flatten ahead of Fed’s July meeting as markets are already more than fully priced for an “insurance” rate cut. “I’m biased toward some flattening” in the 2-10 year part of the U.S. yield curve, said Eugene Leow, rates strategist in Singapore

Greenback Winner ( State Street (NYSE:STT))

The dollar could climb even after the Fed cuts as investors may start to cover underweight positions. “All the roads point to one result: that the dollar could possibly be the sole winner,” said Bart Wakabayashi, branch manager in Tokyo

Avoiding Panic (Commerzbank (DE:CBKG))

“A 50bps cut would smack a bit too much of panic,” said Bernd Weidensteiner, economist in Frankfurt. “After the release of a rather strong employment report on Friday, a large step is unlikely”

Dollar Gain (RBC Capital Markets)

“The dollar would remain as G-10’s highest yielder and that should lend support to dollar in a low vol/carry-obsessed world,” said Daria Parkhomenko, FX strategist in New York