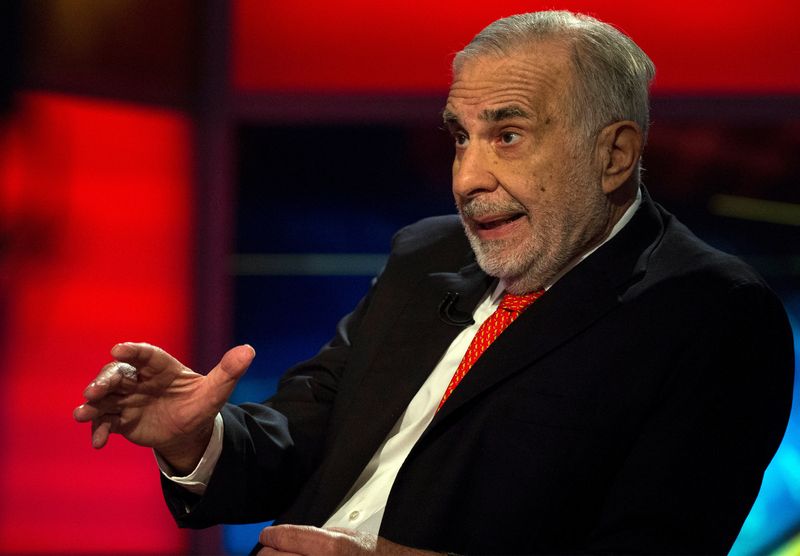

(Reuters) -Shares of billionaire investor Carl Icahn's Icahn Enterprises closed at a more than 20-year low on Monday after the firm said it will sell up to $400 million depository units through an "at-the-market" offering program.

The stock dropped as much as 14.3% to $13.62, the lowest since November 2003, but pared losses to close down 11.5% at $14.07, the weakest since February 2004.

About 6.8 million shares changed hands, making it the busiest session in just over a year.

In a regulatory filing, the company said it intends to use net proceeds from the offering to fund potential acquisitions and for company purposes.

Icahn's office did not immediately provide a comment when called on Monday afternoon.

Icahn and his company last week settled charges with U.S. regulators that for years he failed to disclose pledging the majority of the firm's securities for billions in personal margin loans. Together they agreed to pay $2 million in penalties.

Icahn Enterprises is still at loggerheads with short-seller Hindenburg Research, which last year accused Icahn of running a "Ponzi-like" scheme to pay dividends by overvaluing its holdings. Hindenburg also raised questions about Icahn's margin borrowing.

Jefferies, as sales agent, is handling the share sale program for Icahn Enterprises, a separate statement showed.

Jefferies is the only brokerage to cover the company, rating it a "buy" with a price target of $25, according to LSEG data.