By Lawrence Delevingne

BOSTON (Reuters) -A small Texas investor who caused shares of a real estate investment trust to plunge 39 percent in a day has agreed to pay the company restitution to settle a lawsuit against him, a rare development that could embolden other companies to pursue such claims.

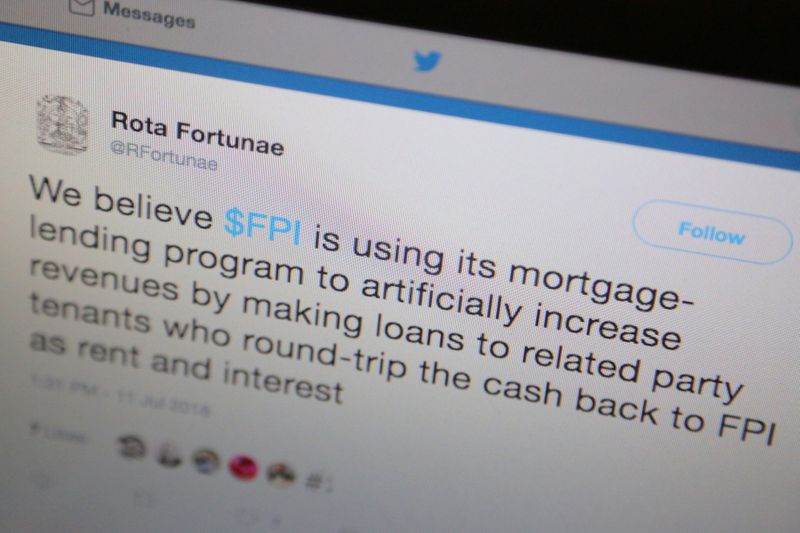

Quinton Mathews, who published his research on companies online under the pseudonym Rota Fortunae, will pay Farmland (NYSE:FPI) Partners Inc "a multiple" of the profits on his short bet in 2018, according to the terms of the legal settlement announced https://twitter.com/RFortunae/status/1406807986232770562/photo/1 late Sunday. His research had helped wipe as much as $115 million off Farmland's market value.

The parties declined requests for comment on the exact value of the settlement.

Mathews conceded that "many of the key statements" in a report https://seekingalpha.com/article/4186457-farmland-partners-loans-to-related-party-tenants-introduce-significant-risk-of-insolvency he published on website Seeking Alpha targeting Farmland - including allegations of dubious related-party transactions and the risk of insolvency - were wrong.

"I regret any harm the article and its inaccuracies caused," Mathews said in the announcement, which was posted on Twitter and Seeking Alpha.

Paul Pittman, Farmland's chief executive officer, said in a statement that "investors already recognize that the company was the victim of a short and distort scheme."

Farmland shares traded around $12.50 on Monday afternoon, up from around $5 after the short campaign. The company has produced trailing total returns of 12.5% over the last three years, about 10 percentage points lower than the specialty REIT sector, according to a Morningstar tracker.

Jacob Frenkel, an attorney with Dickinson Wright who has defended companies against allegations of stock manipulation and was not involved in the Farmland case, said Mathews' apology and payment could build company confidence to pursue similar claims against short sellers.

"It's highly unusual and refreshing to see a company take on this fight, because most will take the short term blow of the attack without pursuing legal vindication," Frenkel said.

George Moriarty, the former executive editor of Seeking Alpha, told Reuters in 2019 that courts had respected the website’s status as a neutral platform, and that its staff vetted all posts (Read more https://www.reuters.com/article/us-usa-stocks-shorts-insight/short-distort-the-ugly-war-between-ceos-and-activist-critics-idUSKCN1R20AW).

After the retraction, Seeking Alpha on Monday took down all articles by Mathews, including the original post on Farmland, and blocked his account, according to website representative Abby Estikangi-Carmel.

Seeking Alpha's policies include author certification that they were not paid to post and, for short reports, that the assertion was run by the target company.

"Regardless of the steps you take, a bad actor may decide to defraud us by violating our policies, as evidently happened here," Estikangi-Carmel said. "Thankfully, it appears to be an isolated incident."

Mathews runs a one-person investigative research business, Dallas area-based QKM LLC, and has published more than a dozen articles on Seeking Alpha.

Farmland's litigation against a hedge fund firm that paid Mathews for research, Sabrepoint Capital Management LP, continues. Sabrepoint founder George Baxter (NYSE:BAX) said his firm had nothing to do with the Seeking Alpha article and that it would "defend itself and its employees vigorously against Farmland's frivolous claims."