By Matt Scuffham

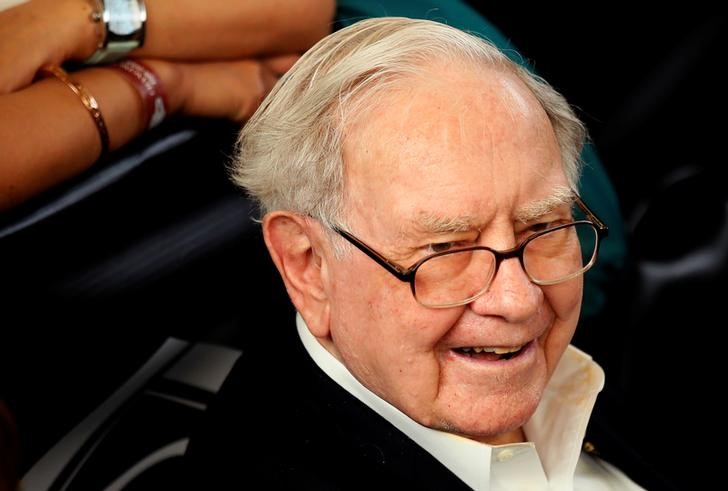

TORONTO (Reuters) - Home Capital's (TO:HCG) shareholders on Tuesday rejected a proposal for Warren Buffett's Berkshire Hathaway to raise its stake in the company, voting against the board's recommendation in a third defeat for the U.S. billionaire this year.

Proxy advisory firm Institutional Shareholder Services last month recommended shareholders vote against the proposal, which called for Berkshire Hathaway (N:BRKa) to increase its shareholding from 20 percent to 38.4 percent.

Home Capital Chairwoman Brenda Eprile told a special meeting of shareholders that 88.79 percent of votes cast were against the proposal, with 11.21 percent in favor.

The deal would have allowed Berkshire Hathaway to buy new shares in the company at a price of C$10.30 per share, a deep discount to Home Capital's closing price of C$14.08 on Monday, which would have impacted the overall value of Home Capital shares.

Shares in Home Capital see-sawed after resuming trading at midday, initially falling as much as 3 percent and later gaining as much as 3.3 percent. At 12:30 EST, the shares were up 0.7 percent at C$14.18.

Concerns over the potential dilution were alleviated by the vote, but analysts remain concerned about what impact tougher rules on mortgage lending in Canada will have on the business.

"We continue to view pending regulatory changes as well as a moderating housing price environment as limits on meaningful earnings growth," said Raymond James analyst Brenna Phelan.

Berkshire did not respond to a request for comment.

Last month, 87-year-old Buffett's effort to buy the Oncor Electric utility in Texas ended in failure, when his $9 billion bid was topped by a $9.45 billion offer from Sempra Energy (N:SRE).

In February, Berkshire had committed $15 billion to help Kraft Heinz Co's (O:KHC) purchase of Unilever Plc (L:ULVR) (AS:UNc), but the proposed takeover was pulled after the Anglo-Dutch consumer products company rejected it.

Home Capital and Berkshire agreed in June to a deal worth up to C$400 million ($329 million) for an initial stake of 20 percent in the business. The agreement enabled Berkshire to increase its stake subject to shareholder approval.

Buffett took his stake in the company and provided a C$2 billion credit facility after investors withdrew more than 90 percent of funds from Home Capital's high-interest savings accounts earlier this year.

The withdrawals accelerated after April 19, when the Ontario Securities Commission accused Home Capital of making misleading statements to investors about its mortgage underwriting business. Home Capital reached a settlement with the commission in June and accepted responsibility for misleading investors.

Home Capital said the terms of the credit facility, on which it does not currently have funds drawn, remain unchanged.

Eprile reiterated the board's belief that the deal would have been in the best interest of the company but said the vote reflected the progress the company has made in its turnaround plan.

"This decision is a clear message that the majority of our shareholders believe that Home Capital's improved deposit inflows and liquidity position diminish the need for additional capital," she said.