Investing.com -- AMD (NASDAQ:AMD) announced on Thursday that it will begin mass production of its new MI325X AI chip in Q4, as it looks to expand its footprint in a market dominated by Nvidia (NASDAQ:NVDA).

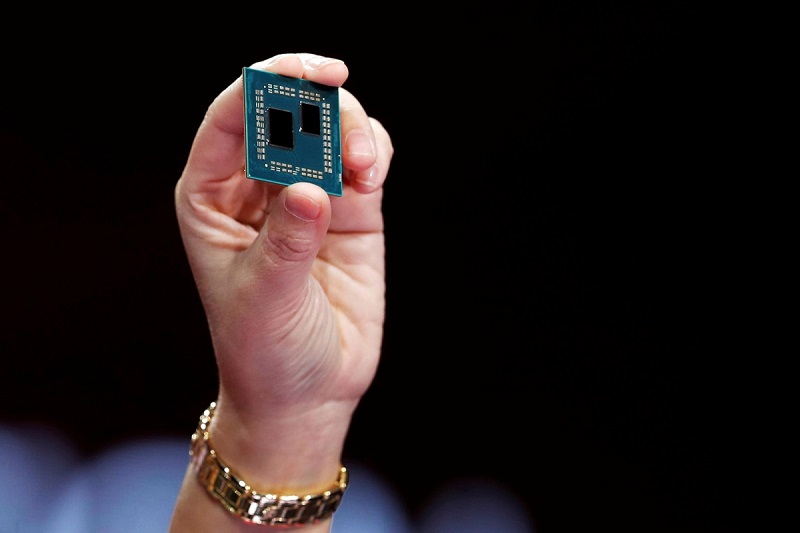

At an event in San Francisco, CEO Lisa Su said AMD's next-generation MI350 chips will launch in the second half of 2025, offering more memory and a new architecture designed to significantly boost performance compared to the MI300X and MI250X models.

Despite the announcements aligning with previous disclosures, AMD shares dropped 4% as investors reacted to the lack of major cloud-computing customers. Meanwhile, Nvidia shares rose 1.6%, and Intel (NASDAQ:INTC) fell 1%.

AMD confirmed that vendors, including Super Micro Computer (NASDAQ:SMCI), will start shipping the MI325X AI chip in early 2025. The chip uses the same architecture as the MI300X but introduces a new memory type to accelerate AI computations. The Santa Clara, California-based chipmaker aims to challenge Nvidia’s Blackwell architecture with the MI325X.

In addition to the AI chips, AMD revealed new networking chips for data centers and three new laptop processors based on the Zen 5 architecture, optimized for AI tasks. The laptop chips will support Microsoft’s Copilot+ software.

Su also stated that AMD will continue to rely on Taiwan’s TSMC for advanced chip manufacturing.

Analysts’ reaction to AMD's AI event

Bernstein: “The stock sold off during and following the event in a typical sell-the-news response, perhaps understandable given some modest excitement into the day, lack of huge surprises, and MI325X performance specs that we believe were likely somewhat disappointing relative to NVIDIA’s impending Blackwell launch. While we don’t want to minimize things we didn’t really hear anything to suggest we should anticipate substantial upside to current expectations, and would rather own NVDA at this point in front of Blackwell.”

Deutsche Bank: “We view the event as a successful continuation of AMD's impressive execution in delivering high-quality Data Center innovations. The increase in its Accelerator TAM from $400b in 2027 to $500b in 2028 suggests continued confidence in the strong growth and share gain opportunities in an important market.”

“Overall, we continue to expect AMD's Data Center segment to be a strong growth driver in 2025 via both share gains in CPUs and the potential for a near doubling of Instinct revenue.”

Bank of America: “New MI325X performance generally remains a full year behind NVDA’s latest Blackwell, with no near-term catalyst to change the dynamic. However, we highlight AMD’s multi-vector growth opportunities across data center CPUs and GPUs remain unchanged, with the current 5-7% AI accelerator share consensus outlook presenting a minimum $25bn+ opportunity by CY28E, and a bull-case scenario of 10% AI share over the long-term still on the table, given continued hardware, software stack, and networking improvements.”

Truist Securities: “We see this as a product evolution rather than a revolution, which reinforced our longer-term concerns with the stock:(1) we see AMD's position in AI as likely confined vs. NVDA's (Buy) full-stack semis/hardware/software/services solutions, and (2) we expect the X86 market will slowly come under pressure from new CPU competitors. No change to our estimates or $156 PT. Hold.”

Morgan Stanley: “AMD launched the new Zen 5 server architecture, the mid-life kicker for MI300, and previewed the MI350. The bull case that MI350 lands them in a leadership position is very compelling, but in the interim MI300 seems likely to drive less upside than we see elsewhere in AI.”