By Natalie Grover and Danilo Masoni

LONDON (Reuters) - Shares of GSK and Sanofi (NASDAQ:SNY) surged on Wednesday, adding more than $20 billion in combined value in early trade following the dismissal of thousands of U.S. lawsuits claiming that the heartburn drug Zantac caused cancer.

The ruling on Tuesday by U.S. District Judge Robin Rosenberg in West Palm Beach, Florida, knocked out about 50,000 claims in federal court on the basis that they were not backed by sound science.

The drugmakers, citing scientific consensus, have repeatedly asserted that Zantac does not cause cancer.

The Florida outcome represents a "nice early Christmas present for the defendants. Was this all just a storm in a tea-cup after all?," Bernstein analysts wrote in a note.

The ruling can still be appealed and the decision does not directly affect tens of thousands of similar cases pending in state courts around the country. In a statement on Wednesday, GSK said it would continue to defend itself vigorously, including against all claims brought at the state level.

Although it is unlikely investors will assume Zantac risk has completely dissipated, Wall Street analysts suggested the probability and scale of future Zantac damages via other legal routes do look significantly lower.

Originally marketed by a forerunner of GSK, the medicine has been sold by several companies at different times, including Pfizer (NYSE:PFE), Boehringer Ingelheim and Sanofi as well as a plethora of generic drugmakers.

On Wednesday, GSK's shares jumped as much as 14% in early trading and were up about 8.5% at 1100 GMT, while Sanofi's stock jumped nearly 6% in mid-morning trading.

Uncertainty surrounding the litigation had wiped almost $40 billion off the market value of GSK, Sanofi, Pfizer and Haleon over roughly a week in August, with shareholders fearing payouts of billions of dollars, similar to cases involving Merck & Co's painkiller Vioxx and Bayer (OTC:BAYRY)'s glyphosate-based weedkiller Roundup.

At their peak, the gains on Wednesday meant GSK and Sanofi had almost recouped all the losses since that brutal selloff in August, adding as much as $21.1 billion in combined market value.

In the first few of hours of Wednesday trading, more of GSK's London-listed stock changed hands than the average for a full day over the past five years, according to Refinitiv data.

Shares of Haleon, which comprises consumer health assets once owned by GSK and Pfizer and was spun out as an independent company in July, were also up about 4%.

Haleon has repeatedly said it was not liable for any potential Zantac liabilities. Barclays (LON:BARC) analysts said they viewed Zantac as substantially derisked, "leaving Haleon investible again for those without the appetite for pharma litigation risk."

CANCER CONCERNS

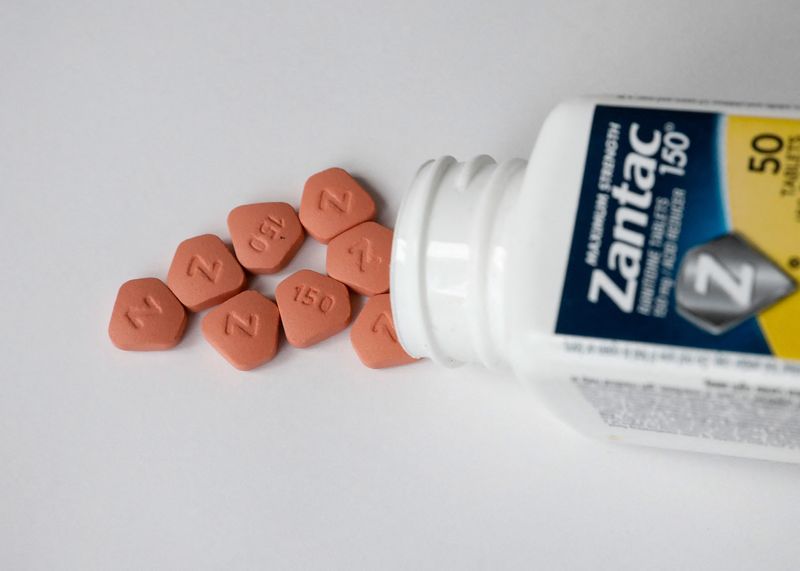

Zantac, first approved in 1983, became the world's best selling medicine in 1988 and one of the first-ever drugs to top $1 billion in annual sales.

Concerns around Zantac containing potential cancer-causing impurities started to emerge in 2018. By 2019, some manufacturers and pharmacies halted sales of the drug over concerns that its active ingredient, ranitidine, degraded over time to form a chemical called NDMA.

While NDMA is found in low levels in food and water, it is known to cause cancer in larger amounts. In 2020, the U.S. health regulator pulled all remaining Zantac versions off the market, citing research showing the amount of NDMA in the products increases the longer the drug is stored and could potentially become unsafe.

Lawsuits began piling up soon after recalls began from people who said they developed cancer after taking Zantac. Plaintiffs said the companies knew, or should have known, that ranitidine posed a cancer risk and failed to warn them.

(Natalie Grover in London and Danilo Masoni in Milan; additional reporting by Tassilo Hummel in Paris and Amanda Cooper in London; editing by Louise Heavens and Elaine Hardcastle)