After already suffering the indignity of trading below its offering price every day since its initial public offering two and a half weeks ago, the meal kit retailer now faces a new hurdle — and surprise, surprise, Amazon (NASDAQ:AMZN) is once again the culprit.

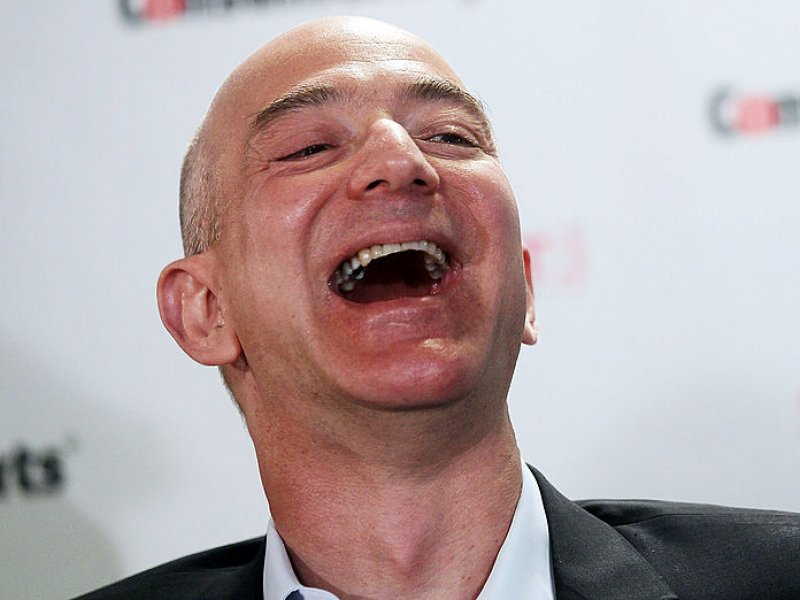

The Jeff Bezos-led juggernaut filed a trademark application on July 6 for "prepared food kits," as reported by TheStreet.com's Laura Berman early Monday morning.

Blue Apron's stock sank 8.3% to $6.75 per share in pre-market trading. It now sits roughly 33% below its IPO price of $10 per share.

It's just the latest Amazon-fueled hit absorbed by flailing Blue Apron, which took a cleaver to its IPO range in the week prior to pricing following Amazon's $13.7 billion acquisition of Whole Foods. Many potential investors identified the possibility of more competition in the food-delivery industry and ran the other way. As such, Blue Apron trimmed its IPO range to $10 to $11 a share, down from $15 to $17.

Sadly enough, Blue Apron's current price looks downright bullish compared to the $2 per share price target it received from Northcoast Research, the first Wall Street firm to weigh in on the company.

While perhaps the most extreme current example, Blue Apron's plight highlights the unfortunate reality facing many companies in the retail industry: Amazon is coming, and there's nowhere to hide.