By Jonathan Stempel

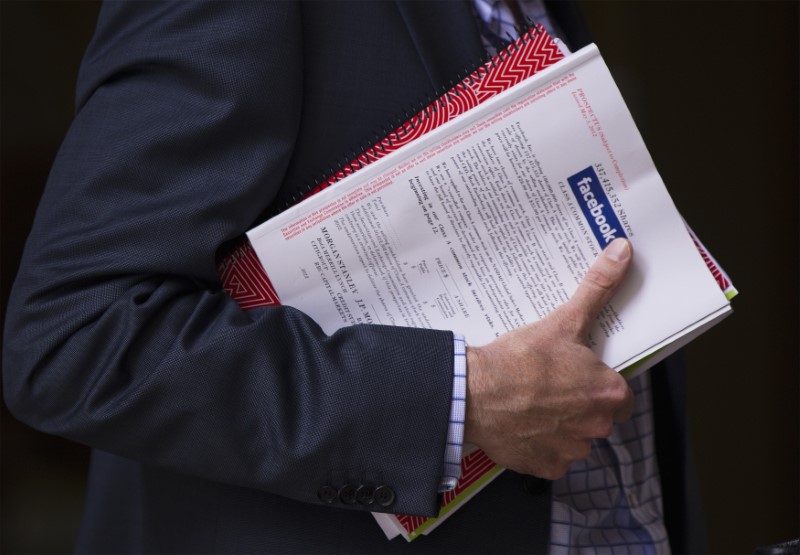

NEW YORK (Reuters) - Goldman Sachs Group Inc (N:GS), JPMorgan Chase & Co (N:JPM) and Morgan Stanley (N:MS) need not forfeit their estimated $100 million of profit from trading Facebook Inc (O:FB) stock soon after underwriting its May 2012 initial public offering, a federal appeals court said on Thursday.

By a 3-0 vote, the 2nd U.S. Circuit Court of Appeals in Manhattan rejected a claim by Facebook shareholder Robert Lowinger that "lock-up" agreements forbade the sales because the banks and selling shareholders together formed a "group" owning more than 10 percent of the social media company's stock.

The lawsuit was one of dozens targeting Facebook, the banks and others after the Menlo Park, California-based company's $16 billion IPO suffered from technical glitches and its stock price slid 54 percent within four months.

Lowinger accused Facebook of concealing pessimistic internal growth projections from the public even as it quietly alerted the banks, who then passed the news to top clients and bet successfully against the stock. He sought to force the banks to turn their profits over to Facebook.

U.S. District Judge Robert Sweet in Manhattan dismissed the lawsuit in May 2014, saying the lock-up agreements restricting insiders from selling stock were standard in the industry.

Upholding that ruling on Thursday, Circuit Judge Ralph Winter said subjecting bank underwriters to similar restrictions would "complicate" their role, add millions of dollars of legal exposure and reduce the number of companies going public.

"IPOs contemplate the sharing of confidential financial information with underwriters, agreements between underwriters and large pre-IPO shareholders limiting disposal of their shares, and trading by underwriters in the course of the offering," he wrote. "Far from being nefarious, these actions benefit existing shareholders and new public investors."

Jeffrey Abraham, a lawyer for Lowinger, declined to comment. Goldman was not immediately available for comment. JPMorgan spokesman Brian Marchiony, Morgan Stanley spokeswoman Mary Claire Delaney and Facebook spokeswoman Vanessa Chan declined to comment.

Judge Sweet oversees separate class-action litigation against Facebook by retail and institutional investors who claim they overpaid for the company's shares.

Facebook's share price has more than tripled from the $38 IPO price, despite the initial decline. The gains have made Chief Executive Mark Zuckerberg the world's fifth-richest person, according to Forbes magazine.

The case is Lowinger v Morgan Stanley & Co et al, 2nd U.S. Circuit Court of Appeals, No. 14-3800.