By Doyinsola Oladipo and Abhirup Roy

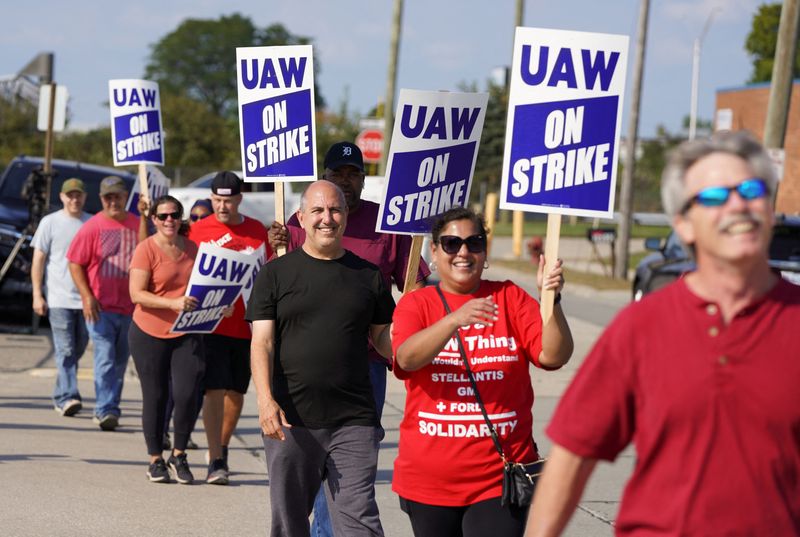

(Reuters) - U.S. auto workers expanded their strike on Friday with a clear target for distress: dealers who sell and service GM and Stellantis (NYSE:STLA) vehicles.

Selling and installing parts is one of the most profitable parts of the auto business, but it is also one of the most vulnerable, because the industry relies on just-in-time shipments. The strategy of choking parts delivery increases problems for some dealers who say it already had been difficult to source some components.

"It's going to become near impossible to get a lot of these parts," said Richard Fasulo, a diagnostic technician from Wappinger, New York, who works for a Cadillac franchise dealer and used car dealers. The broader strike, which targets 38 parts distribution centers owned by GM and Stellantis, "is going to have these shops telling their customers 'We don't know when we can fix your vehicle. It might be indefinitely.'"

Selling repair parts and service returns is the key to many dealers' profits, and returns 40% or better gross profit margins for big auto retail chains such as AutoNation (NYSE:AN) and Lithia.

"If your car doesn't work, you're just stuck. It's just mean, don't you think?" said Howard Drake, a GM dealership owner based in California, describing the difficult situation for customers needing repairs. "I thought the punishment would be in the form of adverse selection for customers with limited choice. I didn't think it would be my lot stacked up with cars that I can't fix because they won't man a parts distribution center," he said.

National Association of Auto Dealers President and CEO Mike Stanton said: "Dealers don't want to see anything to limit our potential to serve customers, so we certainly hope automakers and the UAW can reach an agreement quickly and amicably."

The UAW had been expected to expand their strike by shutting down plants that made the highest-profit vehicles, such as pickup trucks. But automakers have built up vehicle inventory and for many dealers problems with repairs will start soon.

"It's definitely going to impact customers," said Thomas Morris, 60, who went on strike on Friday at a General Motors (NYSE:GM) parts distribution center in the suburbs of Philadelphia.

The center serves GM dealerships from Pennsylvania to Maine, moving some 30,000 parts for auto repairs each day, workers said.

GM said in a statement the company has "contingency plans for various scenarios" while Stellantis said it was awaiting a response from UAW to their "competitive offer" on Thursday and looking forward to a "productive engagement".

Arthur Wheaton, director of labor studies at Cornell's School of Industrial and Labor Relations, said the UAW had made a smart move.

"I think it is a great strategy going after the distribution centers," he added. Services are big business, he said. "That's how they make a lot of their money."

Brad Sowers, the CEO of Jim Butler Auto Group which owns the largest Chevrolet dealership in St.Louis, Missouri, said if a deal is not inked in 60 days he'll be upset, even though he had the foresight to load up on parts in anticipation of the strike.

"I just want them to get together and get it done," he said.