(Reuters) - Cheerios cereal maker General Mills Inc (N:GIS) said on Wednesday it would cut 625 jobs as it looks to reduce costs in the wake of slowing sales of its Yoplait yogurt, as well as rising commodity and freight expenses.

Shares of the company, which also reported a better-than-expected fourth-quarter profit, were up nearly 2 percent in midday trading.

General Mills, which also owns Häagen-Dazs and Betty Crocker brands, has been struggling to turn around its U.S. yogurt business as competitors such as Chobani and Danone (PA:DANO) unleash new flavors and healthier versions of yogurt.

Chief Executive Jeffrey Harmening said he expects new launches, including yogurt with high protein and less sugar, to boost sales in 2019.

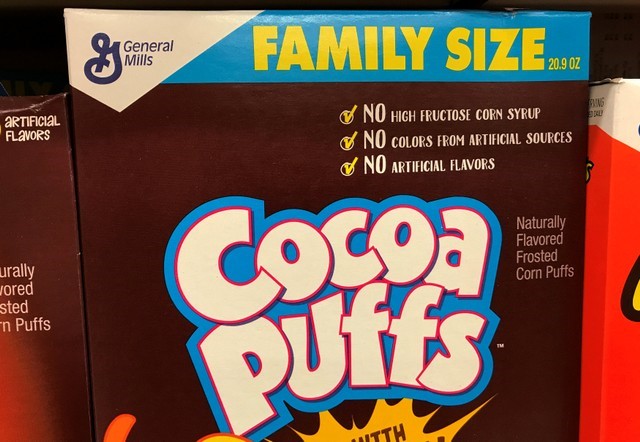

As the company's yogurt sales continue to fall, General Mills has relied on cereals and snack business to help prop up its top line.

For 2019, the company expects total organic net sales to be in the range of flat to up 1 percent in 2019. Including the impact of it acquisition of pet food snacks maker Blue Buffalo, net sales are expected to rise 9 percent to 10 percent from a year earlier.

Net earnings attributable to the company fell 13.4 percent to $354.4 million.

Excluding certain items, General Mills earned 79 cents per share. Analysts were expecting earnings of 72 cents per share, according to Thomson Reuters I/B/E/S.

Net sales rose 2 percent to $3.89 billion, in line with analysts estimate.

Gross margins for the quarter rose to 36.5 percent from 34.7 percent a year earlier.

"We were pleased to see profit margins improve from a year ago as cost savings and increased sales of products with higher profit margins more than offset headwinds from higher transportation and input costs," Edward Jones analyst Brittany Weissman said.