By Peter Nurse

Investing.com -- Stocks in focus in premarket trade on Wednesday, March 23rd. Please refresh for updates.

-

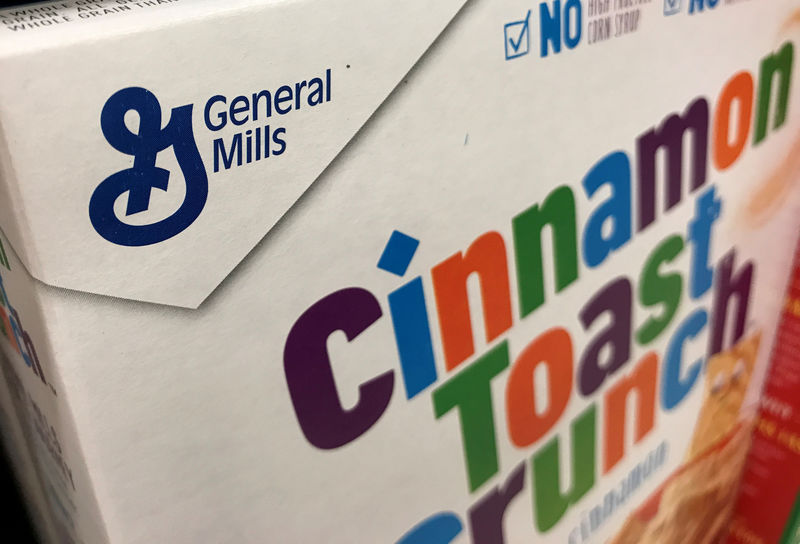

General Mills (NYSE:GIS) stock rose 3.3% after the food processing giant raised its full-year core sales and profit forecast, encouraged by higher prices and strong demand for its cereals, snack bars and pet food.

-

Adobe (NASDAQ:ADBE) stock fell 3.1% after the software giant beat its first-quarter targets, but disappointed with its guidance, warning of a hit to its digital media business in Ukraine.

-

GameStop (NYSE:GME) stock rose 13% after Chairman Ryan Cohen's investment company bought 100,000 shares of the videogame retailer, raising its stake to just under 12%.

-

BP (NYSE:BP) ADRs rose 2.8% after Morgan Stanley upgraded its stance on the oil major to ‘overweight’ from ‘equal-weight’, saying the U.K. energy company’s Russia risk is now fully priced in.

-

T-Mobile US (NASDAQ:TMUS) stock rose 0.7% after KeyBanc lifted its stance on the wireless network operator to ‘overweight’ from ‘sector weight’, saying the company has the “best-in-class” 5G network.

-

Boeing (NYSE:BA) stock fell 0.5%, with the aircraft manufacturer still in focus after Chinese authorities recovered one of the black boxes of a China Eastern Airlines (NYSE:CEA) jet, a Boeing 737-800, that crashed on Monday.

-

Tencent Holdings (OTC:TCEHY) ADRs are expected to fall after the Chinese social media and gaming giant posted an 8% rise in fourth-quarter revenue, its slowest growth since going public in 2004.

-

Poshmark (NASDAQ:POSH) stock fell 10% after the new and used clothing marketplace disappointed with its guidance for the current quarter.