By Aatreyee Dasgupta and Mike Stone

WASHINGTON (Reuters) - General Dynamics (NYSE:GD) reported second-quarter revenue above Wall street estimates on Wednesday, but profit slightly missed and fewer high end jets were delivered than expected, and its shares fell 5%.

Despite a 50% increase in business jet deliveries in the quarter, the Gulfstream parent only handed over 11 of its top-of-the-line, most expensive G700 business jets, below the company target of 15.

The U.S. Federal Aviation Administration certified the G700 business jet just days before the quarter began, however persisting supply chain issues caused delivery delays.

"Q2's EPS miss reflected a large shortfall at Gulfstream, which outweighed robust defense results," TD Cowen analysts said in a note, adding that they expected investors to be disappointed.

The defense contractor reported an 18% rise in second-quarter revenue on Wednesday, helped by higher demand for its ammunition and nuclear-powered submarines.

"In the Aerospace segment, we are continuing to ramp up the pace of our G700 deliveries and our defense businesses continued to grow, reflecting increased demand in response to the threat environment," CEO Phebe Novakovic said in a statement.

Despite cost pressures due to constraints on the U.S. defense budget, defense firms continue to see strong demand for military equipment amid ongoing geopolitical conflicts.

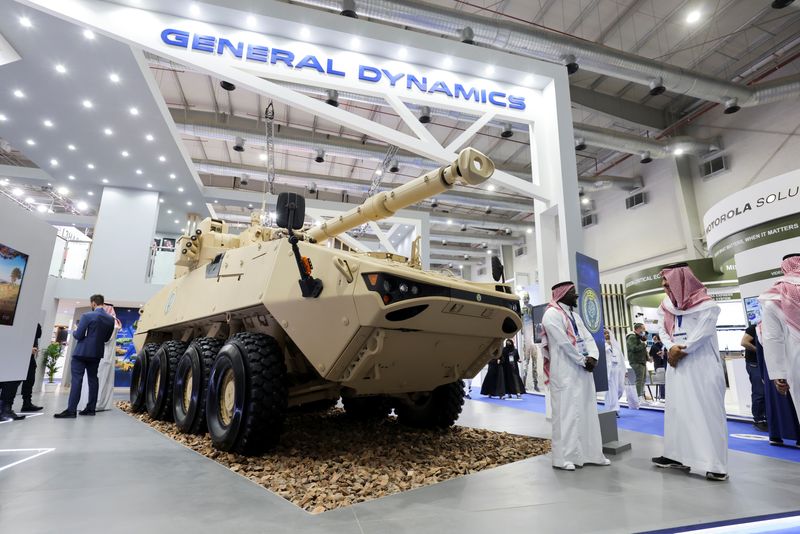

Profits at General Dynamics' combat systems unit, which makes vehicles and tanks, were $313 million in the quarter, up 25% from a year ago.

The company now sees combat systems' annual revenue at $8.7 billion, a $200 million hike from its prior forecast.

It also lifted the full-year revenue forecast for its marine systems segment, which builds nuclear-powered submarines and ships, by $1 billion and now expects $13.4 billion to $13.8 billion.

General Dynamics reported quarterly earnings of $3.26 per share, missing analysts' estimates by one cent. Revenue of $11.98 billion was well above analyst estimates of $11.44 billion, according to LSEG data.

The Reston, Virginia-based company now sees total revenue for the year coming in at $47.8 billion to $48.2 billion, up from its previous forecast of $46.6 billion to $46.7 billion.

General Dynamic shares were off 4.6% at $280.80 in midday trading.

The $95 billion in Ukraine and Israel aid bills passed by Congress earlier this year were expected to boost the order backlog for General Dynamics, which makes some of the artillery in heavy use in Ukraine.

Other major companies that receive government contracts, such as Lockheed Martin (NYSE:LMT), RTX Corp and Northrop Grumman (NYSE:NOC) should also eventually expect a lift from the funds.