By Rajesh Kumar Singh and Abhijith Ganapavaram

NEW YORK (Reuters) -General Electric's aerospace business on Thursday forecast operating profit of about $10 billion in 2028 on robust demand for its products and services, and said it was targeting an initial dividend payout at 30% of net income.

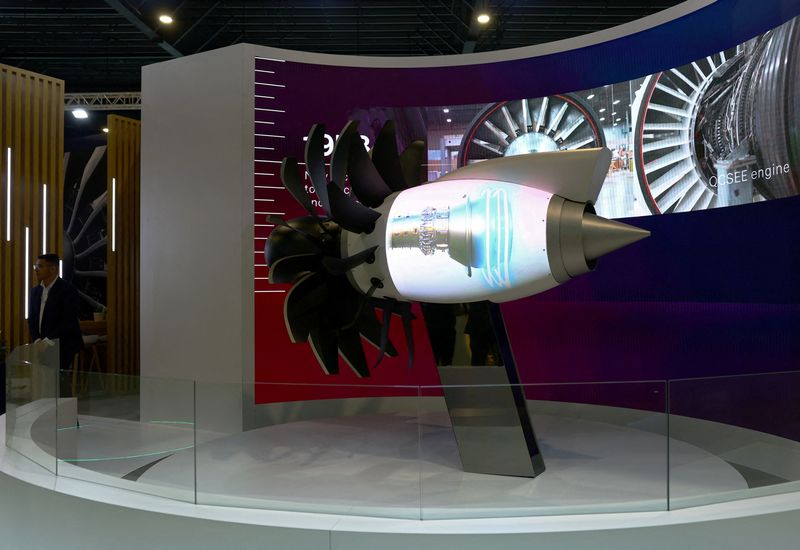

GE Aerospace, which makes engines for Boeing (NYSE:BA) and Airbus jets, has experienced a surge in demand for aftermarket services as a strong rebound in travel and a shortage of new jets prompt airlines to keep planes in the air for longer.

"We really are at a point in time where demand isn't our challenge," GE CEO Larry Culp said at the unit's investor conference. "And we think we've got quite a runway in front of us."

GE's shares were up 2.9% at $164.07 on Thursday afternoon. The shares have gained 30% so far this year.

Culp voiced support for Boeing CEO Dave Calhoun, who has been dealing with a crisis following a mid-air panel blowout on a 737 MAX jet on Jan. 5. He said GE has continued to deliver engines - which it produces through the CFM joint venture with France's Safran (EPA:SAF) - at the same rate as prior to the incident.

GE Aerospace reaffirmed its 2024 targets and authorized up to $15 billion in share repurchases as part of its plans to return 70% to 75% cash to shareholders.

More than 70% of the $24 billion annual revenue that the unit's commercial engines business generates comes from services.

The company said customers want more engines and aircraft to be able to meet their continued growth and demand projections. However, meeting the demand remains a challenge as the supply chain is not able to ramp up at the speed desired by the company.

"If we've got backlog into the 2030s, you know we've got a lot to do," Culp said. "And it's a day-to-day challenge."

Boeing recently delayed its expected ramp-up of MAX production due in part to increased scrutiny from regulators. Culp said he is not thinking about switching production capacity to Airbus away from Boeing, adding that the company's relationship with Boeing has "never been stronger."

GE Aerospace said 2024 growth in deliveries of LEAP engines is estimated to be 20%-25% versus a year ago, with the pace expected to accelerate in 2025 and 2026. A company executive said GE Aerospace expects to deliver more than 2,000 LEAP engines in 2025.

Once a diversified industrial conglomerate, GE said in 2021 it would break up into three companies focused on aviation, healthcare and energy. GE separated its healthcare business last year and its energy and aerospace businesses will be spun off into independent companies on April 2.

GE Aerospace has been a cash cow for the Boston-based company, with some analysts estimating its market value at more than $100 billion after the spinoff.

On Thursday, the unit reaffirmed its 2024 forecast of $6.0 billion to $6.5 billion in adjusted operating profit, more than $5 billion in free cash flow and a low-double digit or higher growth rate in adjusted revenue.

In 2025, operating profit is expected to rise to $7.1 billion to $7.5 billion, while adjusted revenue is set to grow in low-double digits.

Culp said GE Aerospace will focus on M&A deals that complement and accelerate its business.