Investing.com’s stocks of the week

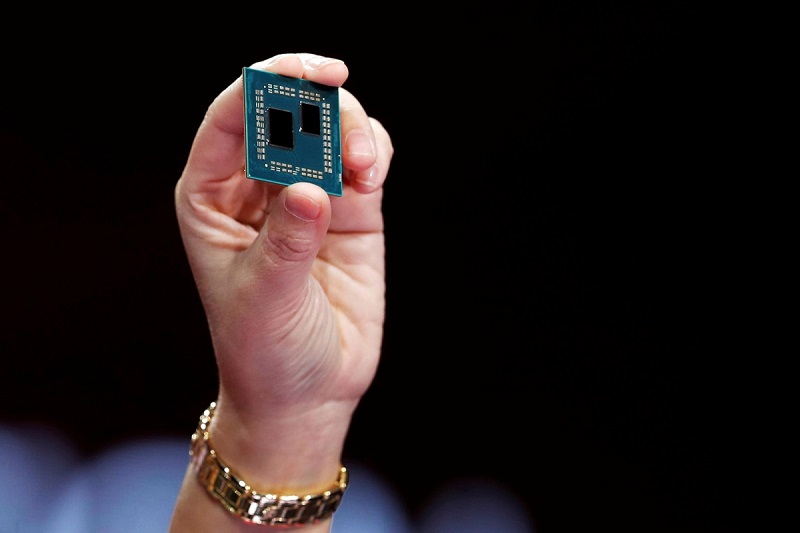

Given the rising demand for advanced chips, breakthroughs in chipmaking, and increasing efforts to address the chip shortage make popular chipmakers Taiwan Semiconductor Manufacturing (TSM), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM), Micron Technology (NASDAQ:MU) are well-positioned to capitalize on the industry’s tailwinds and deliver better returns than Advanced Micro Devices (NASDAQ:AMD).Since 2014, CEO Lisa Su’s leadership has helped chipmaker Advanced Micro Devices Inc. (AMD) make a strong comeback from bankruptcy. The company has gained over 1,680% over the past five years. Consistent product innovations have made AMD a rival to Intel Corporation (NASDAQ:INTC) in the CPU market and NVIDIA Corporation (NASDAQ:NVDA) in the GPU market. Also, the company has recently been awarded a contract from Meta Platforms, Inc. (FB) to provide its EPYC chip processors to power its data center computers.

This, combined with its better-than-expected results in the third quarter, has helped the stock gain investor attention over the past month, as evident from its 33.6% gain during the period. However, a Northland Securities analyst has downgraded the stock recently on concerns over lower demand for its semiconductors, high inflation, and INTC’s yet-to-launch Alder Lake lineup of processors. These factors could lead to AMD witnessing a slowdown next year. In addition, given its lofty valuation and rising mentions on the r/WallStreetBets dashboard, analysts expect AMD to witness a pullback in the near term.

Despite the global chip shortage, the industry witnessed 27.6% year-over-year sales growth in the third quarter. Rising government and corporate investments and various measures to address this crisis will likely improve the situation by the second half of 2022. Moreover, innovation in the chipmaking process and manufacturing of advanced chips should foster the industry’s growth. Investor optimism in this space is evident from the SPDR S&P Semiconductor ETF’s (XSD) 18.3% gains over the past month versus the SPDR S&P 500 Trust ETF’s (SPY) 4.1% returns. The global semiconductor market is expected to grow at a 7.7% CAGR to $778 billion by 2026.