HONG KONG (Reuters) - Fitch Ratings downgraded Dalian Wanda Commercial Management Group to "restricted default (RD)" from "C" on completion of the distressed debt exchange, and simultaneously upgraded the firm to "CC" from "RD" to reflect its post-restructuring profile.

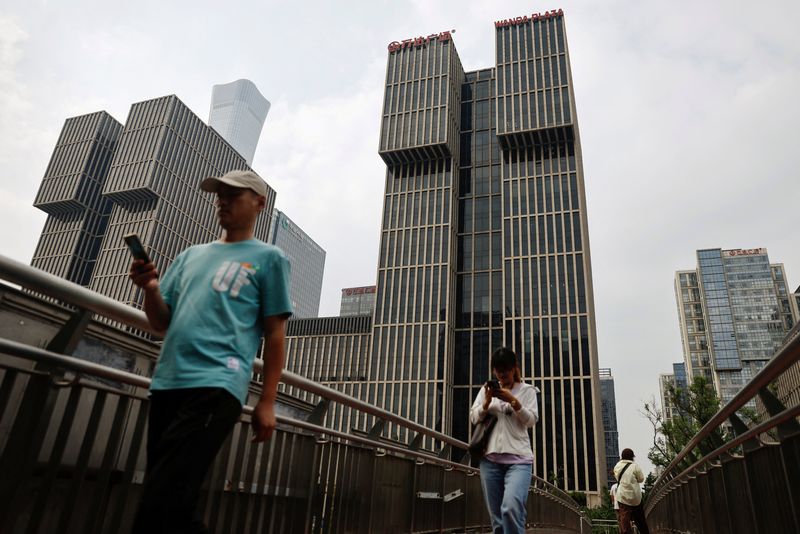

Fitch said in a statement on Thursday the same rating actions also applied to Wanda Commercial Properties (Hong Kong) Co. Limited, also a unit of Dalian Wanda Group, China's largest commercial property developer.

Wanda Properties last week got official approval to extend the maturity date of its $600 million 7.25% note to Dec. 29, 2024, from Jan. 29.

It also avoided an immediate repayment of more than $4 billion to its investors, which include private equity investor PAG, after reaching an agreement with them for them to reinvest in unit Zhuhai Wanda at the end of the year after they were paid back on their original stake.

"We believe that the margin of safety from Wanda Commercial's liquidity in 2024 is still low, as there are still execution risks related to getting pre-IPO investors to agree to a new arrangement," Fitch said in the Thursday statement.

"(But) once the pre-IPO refinancing is completed as planned by the company, Wanda Commercial will have sufficient liquidity to repay the remaining bond maturities," Fitch said, adding it may consider positive rating action to reflect the latest capital structure.