By Chris Taylor

NEW YORK (Reuters) - Fathers pass down many things to their kids, but not just genetic traits like eye color or hairlines.

Another inheritance, perhaps the most impactful of all: Money habits.

After all, kids see and hear much more than you realize. So if you are a parent who saves and is thoughtful about spending, your children are picking that up. If you are racking up debts and getting late on your bills, your kids are absorbing that, too.

In honor of Father’s Day, Reuters asked a few prominent Americans about the financial habits they got from their own fathers.

Al Roker

Co-host, 3rd hour of TODAY Show; weather and feature anchor, TODAY

The financial advice I got from my dad was to make sure to hand it to someone who knows what they’re doing. My father admittedly didn’t know a whole lot about money, and my mom ran all the finances. So he would hand my mother his check, and she is the one who paid for stuff and put money in the bank. As long as they lived, that was the way it worked.

Ironically, at his job, he was responsible for handling large sums of money every day. He was a bus driver, and I used to ride the bus with him. Back in those days there were no MetroCards, so people paid for rides in cash, and he would have to tally it all up at the end of the bus route.

When I started to have after-school jobs, I did the same thing as him, and would hand the money to my mom to put it in the bank. She was pretty savvy about money – strict about saving, and about giving to charity, since she was very involved in her church.

Nowadays, with my son who is almost 17, I make sure to give him an allowance in cash. I think it’s important for kids to handle cash, not just debit cards, and see how it goes from Point A to Point B. That way they realize that money doesn’t just magically appear.

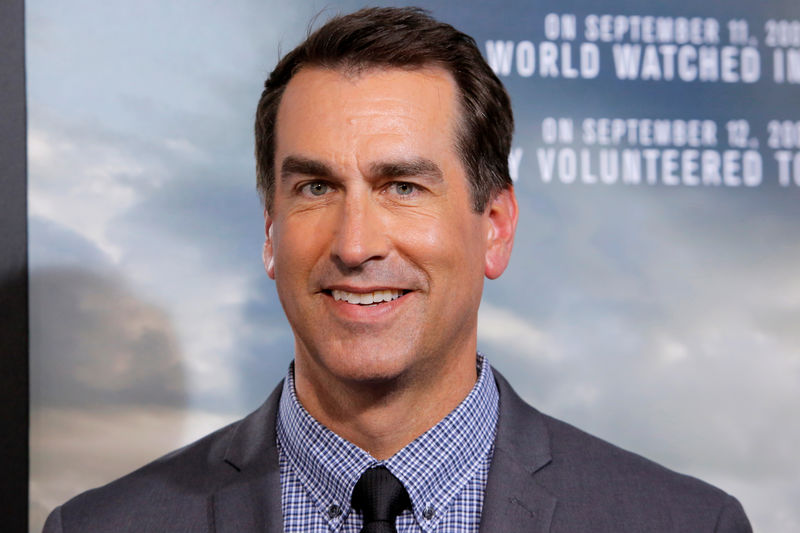

Rob Riggle

Actor, "12 Strong"; Commentator, ABC’s "Holey Moley" (premieres Thursday June 20, 8 pm)

Two things he always stressed, and these were lessons I learned early, even back when we were playing Monopoly on Thanksgiving. One was to do your best to avoid debt whenever possible. Save as much as you can, and pay for things out of earnings.

The second thing was to invest early, and often, and consistently. The sooner you put it to work, the more time it has to work for you. As a young adult I was a second lieutenant in the Marine Corps, with very small paychecks.

But he stressed that even if it was just 50 bucks, put it into a fund. You won’t see it, you won’t even think about it. And he was right: For most of the ‘90s little bits of money were being funneled from my paycheck, and over time it grew for me.

As for Monopoly: My dad would always beat me, and I used to cry.

Ariana Rockefeller

Businesswoman, athlete, designer

The best financial advice I got from my dad was to keep track of every dollar I spend. We have a family tradition that started with my great-great-grandfather, John D. Rockefeller Sr., who wrote down everything he spent in a ledger.

So I got my first ledger from my dad, David Rockefeller Jr., when I first started getting an allowance around 10 years old. It’s a little lined notebook that helps you track input and output, so you can budget and plan efficiently. To this day I still uphold that habit.

I really do try to make a conscious effort to track the smaller things, like lunches, as well as larger items. You have to be mindful of what you’re taking out of your wallet. It has served me well, and taught me to have respect for money.

I kept that paper ledger all the way until college, but these days I use an Excel spreadsheet. I guess I should use an app, but that system works for me.

(The writer is a Reuters contributor. The opinions expressed are his own.)