By Fanny Potkin and Yantoultra Ngui

SINGAPORE (Reuters) - A growing number of Chinese semiconductor design companies are tapping Malaysian firms to assemble a portion of their high-end chips, keen to hedge risks in case the U.S. expands sanctions on China's chip industry, sources said.

The companies are asking Malaysian chip packaging firms to assemble a type of chip known as graphics processing units (GPUs), according to three people with knowledge of the discussions.

The requests only encompass assembly - which does not contravene any U.S. restrictions - and not fabrication of the chip wafers, they said. Some contracts have already been agreed, two of the people added.

The people declined to disclose the names of the companies involved or to be identified, citing confidentiality agreements.

Seeking to limit China's access to high-end GPUs that could fuel artificial intelligence breakthroughs or power supercomputers and military applications, Washington has increasingly placed restrictions on their sales as well as on sophisticated chip-making equipment.

As those sanctions bite and an AI boom fuels demand, smaller Chinese semiconductor design firms are struggling to secure sufficient advanced packaging services at home, analysts have said.

Some of the Chinese companies are interested in advanced chip packaging services, two people said.

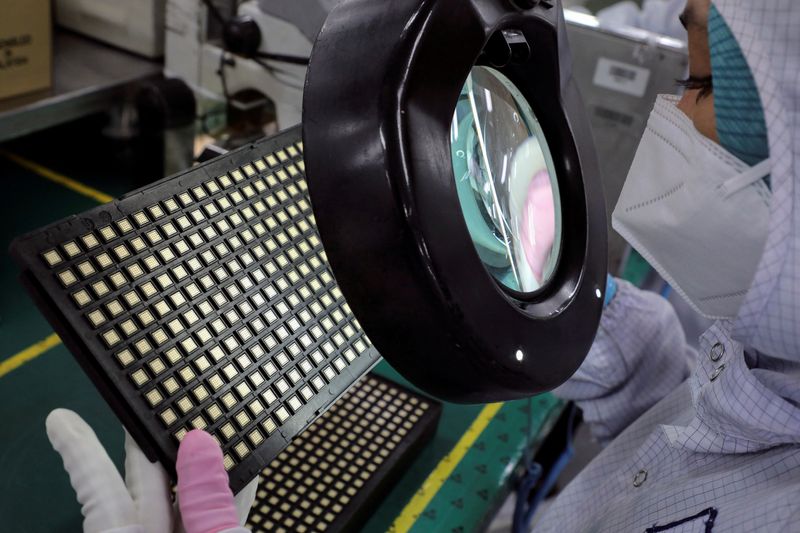

Advanced packaging of chips can significantly improve chip performance and is emerging as a critical technology in the semiconductor industry. This sometimes involves the construction of chiplets where chips are packaged tightly to work together as one powerful brain.

Although not subject to U.S. export restrictions, it's an area that can require sophisticated technology which the firms worry might one day be targeted for curbs on exports to China, the two people added.

Malaysia, a major hub in the semiconductor supply chain, is seen as well placed to grab further business as Chinese chip firms diversify outside of China for assembling needs.

Unisem, whose largest shareholder is China's Huatian Technology, and other Malaysian chip packaging companies have seen increased business and inquiries from Chinese clients, said one source who was briefed on the matter.

Unisem Chairman John Chia declined to comment on the company's clients but said: "Due to trade sanctions and supply chain issues, many Chinese chip design houses have come to Malaysia to establish additional sources of supply outside of China to support their business in and out of China."

Chinese chip design firms also see Malaysia as a good option because the country is perceived as being on good terms with China, is affordable, with an experienced workforce and sophisticated equipment, two of the sources said.

Asked whether accepting orders to assemble GPUs from Chinese firms could potentially provoke U.S. ire, Chia said Unisem's business dealings were "fully legitimate and compliant" and the company did not have the time to worry over "too many possibilities".

He noted that most of Unisem's customers in Malaysia were from the United States.

The U.S. Department of Commerce did not respond to requests for comment.

Other big chip packaging firms in the country include Malaysian Pacific Industries and Inari Amertron. They did not respond to Reuters requests for comment.

Chinese companies are also interested in having their chips assembled outside China as that could also make it easier to sell their products in non-Chinese markets, said one source, an investor in two Chinese chip startups.

A MAJOR HUB

Malaysia currently accounts for 13% of the global market for semiconductor packaging, assembly, and testing and is aiming to boost that to 15% by 2030.

Chinese chip firms that have announced plans to expand in Malaysia include Xfusion, a former Huawei unit, which said in September it would partner with Malaysia's NationGate to manufacture GPU servers - servers designed for data centres and which are used in AI and high-performance computing.

Shanghai-based StarFive is also building a design centre in Penang, and chip packaging and testing firm TongFu Microelectronics said last year it would expand its Malaysia facility - a venture with U.S. chipmaker AMD (NASDAQ:AMD).

Offering an array of incentives, Malaysia has attracted multi-billion dollar chip investments. Germany's Infineon (OTC:IFNNY) said in August it would invest 5 billion euros ($5.4 billion) to expand its power chip plant there.

U.S. chipmaker Intel (NASDAQ:INTC) announced in 2021 that it would build a $7 billion advanced chip packaging plant in Malaysia.

Chinese companies are not just choosing Malaysia. In 2021, JCET Group, the world’s third-largest chip assembly and testing company, completed an acquisition of an advanced testing facility in Singapore.

Other countries such as Vietnam and India are also seeking to expand further into chip manufacturing services, hoping to lure clients keen to minimise U.S.-Sino geopolitical risks.

($1 = 0.9272 euros)

(This story has been corrected to clarify that Huatian Technology is Unisem's largest shareholder, not majority shareholder, in paragraph 11)