By Bernie Woodall

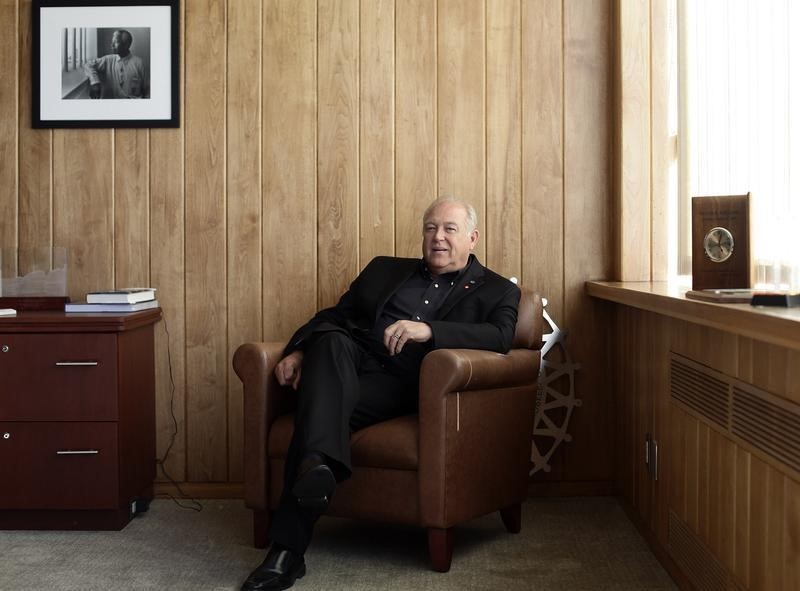

DETROIT (Reuters) - United Auto Workers President Dennis Williams, whose union indirectly controls the largest single block of General Motors Co (N:GM) shares, told Reuters an investor group's proposal that GM buy back $8 billion of its stock is premature, and the amount too high for the company's long-term health.

An investment firm controlled by Harry Wilson, a former member of the U.S. government task force that restructured GM through bankruptcy in 2009, together with four other hedge funds, is urging it to return part of its roughly $25 billion cash trove to shareholders.

Williams, who said he met Tuesday with Harry Wilson to discuss the proposal, left open the possibility that he could endorse a smaller share repurchase.

"I personally don't have a problem with Harry, but that doesn't mean I necessarily agreed with his total analysis of the company," Williams told Reuters on Friday. He described his meeting with Wilson as "informative and frank." .

The UAW, through a retiree medical trust, controls about 8.7% of the automaker's shares, according to government filings. The voluntary employees benefit association, or VEBA, trust, designed to fund UAW retirees' medical care, has influence with other funds that it hires to manage its investments. Williams has a seat on the VEBA's board.

Wilson, head of Maeva Group LLC, leads a group of hedge funds, including Taconic Capital Advisors, Hayman Capital Management, HG Vora Capital Management and Appaloosa Management pressing GM Chief Executive Mary Barra to return $8 billion of that cash in a share buyback over the 12 months following the automaker's annual meeting in June.

The activists also wants GM to give Wilson a seat on the board. In a letter to GM, Wilson wrote that the company is "substantially overcapitalized" while its shares are "substantially undervalued."

The group Wilson leads has disclosed owning about 31.2 million shares, or about 1.9% of GM's stock. Wilson declined to comment.

GM earlier in February said it planned to boost its quarterly stock dividend by 20 percent, and Chief Financial Officer Chuck Stevens indicated the company could distribute more cash to shareholders later in the year.

GM has turned to investment banks Morgan Stanley (MS.N) and Goldman Sachs (NYSE:GS) Group Inc (GS.N) for advice on how to respond to the investor group's proposal.

Williams said he is concerned that GM will need to make substantial investments in new models and technology to stay competitive, and to meet stricter fuel economy and emissions requirements. GM has outlined plans to boost capital spending in 2015 by 20 percent to $9 billion. Some of that investment will flow to U.S. factories that employ some of GM's 49,900 UAW members.

The company also faces a risk of hefty legal settlements related to its mishandling of safety recalls. GM executives have also said they need to stay on course to regain investment grade credit ratings from all the major rating agencies.

(Corrects number of hedge funds in paragraph 2 and shares they own in paragraph 8; adds reference to HG Vora Capital Management in paragraph 6)

(Additional reporting By Joe White; Editing by Christian Plumb)