By Sam Nussey

TOKYO (Reuters) - SoftBank Group Corp is slashing jobs at its global robotics business and has stopped producing its Pepper robot, according to sources and documents reviewed by Reuters, as the conglomerate downgrades its industry ambitions.

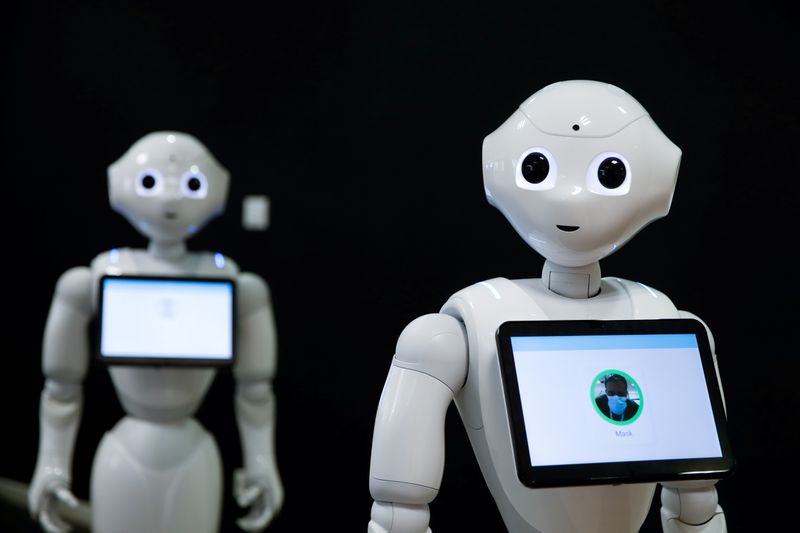

Production of the humanoid Pepper, touted as the first robot with "a heart", was stopped last year, according to three sources familiar with the matter and the documents. It would be costly to restart production, two of the sources said.

Built by Foxconn in China, Pepper was meant to help plug labour shortages but struggled to find a global customer base. Only 27,000 were produced, one of the sources said.

The pullback reflects the fading of Chief Executive Masayoshi Son's plan to make SoftBank the leader in the robotics industry, producing human-like machines that could serve customers and babysit kids.

As part of the retrenchment, SoftBank plans to eliminate about half of its 330 staff positions in France in September, according to four sources and documents, cutting into the historical heart of the business, whose origins lie in SoftBank's 2012 acquisition of French robotics firm Aldebaran.

Half of the staff has already been cut from smaller sales operations in the United States and Britain, three of the sources said, with employees in Japan redeployed from the robotics business. All the sources declined to be named as they are not permitted to speak to the media.

In France, negotiations on layoffs are ongoing with final numbers not decided, a SoftBank spokesperson said. Staff have also been laid off in the U.S. and UK and redeployed in Japan, the spokesperson said, declining to provide further deals.

SoftBank "will continue to make significant investments in next-generation robots to serve our customers and partners," the French robotics business said in a statement.

The job cuts in France were first reported by French business website Le Journal du Net. The broader restructuring is reported by Reuters for the first time.

CULTURE CLASHES

SoftBank Robotics launched the chest-high Pepper in 2014 and it became the face of the conglomerate, embodying Son's optimistic vision of a technology-powered future as he built his overseas investing operations.

Behind the scenes, culture clashes between the French business and Tokyo management hurt the robot's development and its sales were impacted by its limited functionality and unreliability, the three sources said.

SoftBank, which propped up Pepper sales by placing the robot in its mobile phone stores, has shifted focus to products such as cleaning robot Whiz. The French business was increasingly sidelined, the three sources said.

The conglomerate has been selling assets including the majority of its stake in robotics firm Boston Dynamics as Son focuses more on investing through the Vision Fund.

The 63-year-old billionaire, who made his fortune through selling mobile phones contracts and investing in startups, describes SoftBank as a "capital provider for the information revolution."

SoftBank retains exposure to robotics and automation technology, owning SB Logistics and with stakes in robotics firm Berkshire Grey and warehouse robotics firm AutoStore.