By Tracy Rucinski and Tom Hals

CHICAGO/WILMINGTON, Del. (Reuters) - American Apparel's

Los Angeles-based American Apparel Inc, known for its "Made in the U.S.A" fashion, filed for bankruptcy in October, saddled by debt, excess inventory and millions of dollars in legal claims tied to Charney, who was fired in December 2014.

American Apparel wants approval for a plan that will bring the company out of bankruptcy under the control of hedge fund investors, including Standard General and Monarch Alternative Capital.

Last week, the company's board rejected a $300 million takeover bid involving Charney.

"I'm anxious," Charney told Reuters at the hearing. "I put a lot of years into this company."

American Apparel, which has not been profitable since 2009, joins other teen-focused retailers, including Wet Seal and Body Central Corp, that have struggled with changing tastes.

U.S. Bankruptcy Judge Brendan Shannon in Wilmington, Delaware, must decide if the hedge fund-backed plan, which has the backing of a committee of the company's creditors, is fair and feasible.

Charney has filed the main objection. The company's controversial founder could testify as soon as Wednesday afternoon to try to convince the judge that his plan should have been accepted by the company's board.

Charney's plan has the backing of Hagan Capital Group and Silver Creek Capital Partners.

The company's current chief executive, Paula Schneider, told the court she joined a year ago and found a company without cash, long-term planning or proper structure. "There was no org chart. Seventy people told me they had reported to Dov Charney."

Schneider said the hedge fund-backed plan was the only viable alternative for American Apparel. The hedge funds hold the company's bonds and oppose the Charney plan, and Schneider said going against the funds' wishes risked drawn-out litigation that the company might not survive.

Retail analyst Burt Flickinger said that, given the deteriorating retail environment, the best option for American Apparel was quick court approval of the current bankruptcy plan.

"Every day and week of delay adds viability risk to the plan," said Flickinger, who is managing director of retail consultancy Strategic Resource Group.

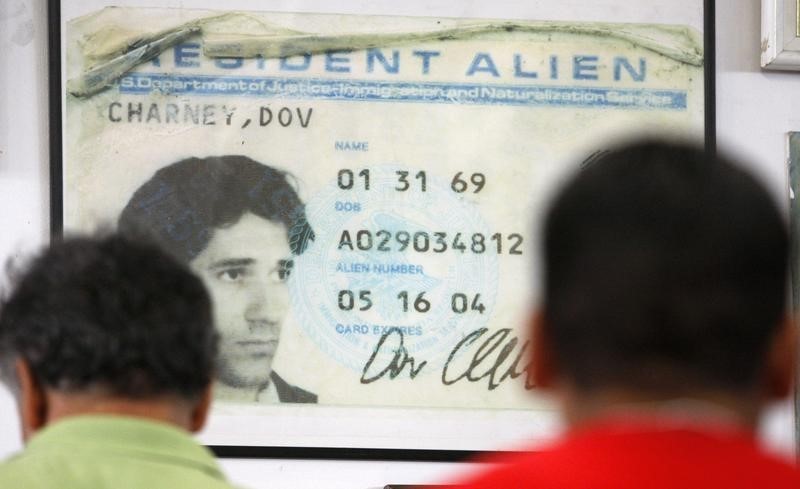

Charney founded American Apparel in 1989, but was fired for allegedly misusing company funds and failing to stop a subordinate from defaming former employees. He has denied the allegations.