By Clara Denina

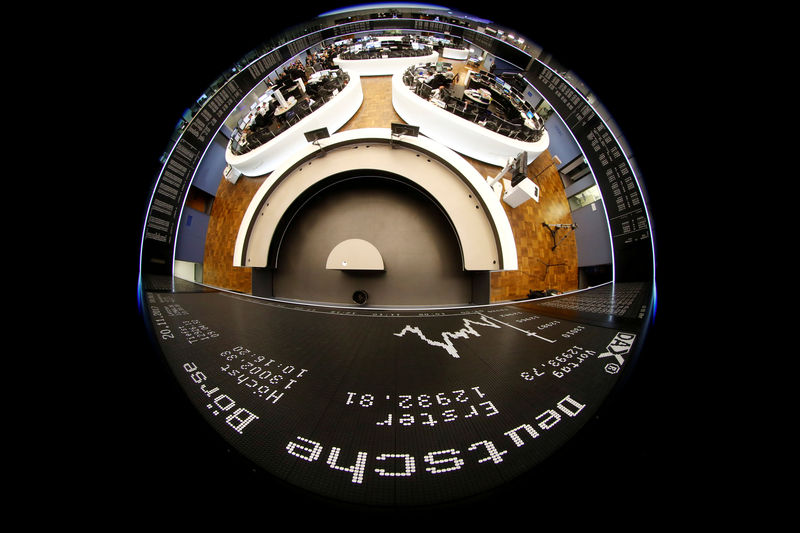

LONDON (Reuters) - European initial public offerings slumped to their lowest since the aftermath of the 2008 financial crisis in the first quarter of 2019, as uncertainty over Brexit and the U.S.- China trade dispute leaves companies not wanting to take their chances.

Proceeds from European listings dipped to $292 million in the first three months of 2019, compared to $13.9 billion made in the same period a year ago, Refinitiv data shows.

Those without the appetite to go public with their shares are instead looking to private stake sales and cash injections, previously favored among tech start-ups.

In London, Europe's biggest stock market, just two companies have listed on the LSE's main market so far this year - law firm DWF Group, which raised 75 million pounds ($100 million) and software company Dev Clever , raising just 678,000 pounds. In total, 11 companies went public in Europe.

Meanwhile, private equity Carlyle Group (NASDAQ:CG) is in talks to buy a 30 percent stake in Spain's Cepsa for up to $3.4 billion, just months after its Abu Dhabi owner Mubadala shelved a listing of the energy company, sources have told Reuters.

The lack of companies joining the stock market to raise capital is in stark contrast to just a few months earlier, when, with much fanfare carmaker Aston Martin made its debut.

"Given the Brexit-related uncertainty in the market is still ongoing, we have a couple of IPOs for which we have done most of the work that have now been pushed to the end of the year," one banking source said, expecting a pick-up later in 2019.

Bankers say some companies are put off because they cannot achieve top valuations that were available up to a year ago.

Firms such as Aston Martin and financial technology firm Funding Circle, which also listed in London late last year, have performed poorly and are still trading down sharply from their debut prices.

The collapse in listings bodes ill for the prospects of the financial institutions that profit from them.

Just $3.64 million has been collected by banks in fees from European IPOs so far this year, down from $114.31 million in the same period of 2018, according to Refinitiv data.

The drought has pushed ECM bankers to find alternative ways to bring in fees.

Some said they are spending more time working on private placements of shares or scouting out companies in distressed situations that need fresh capital.

Online wealth manager Nutmeg raised $58.2 million from investors in January, including Goldman Sachs Group (NYSE:GS) while mobile-only bank Monzo raised 20 million pounds from its existing customers in December after an 85 million pounds funding.

"Having the public investor community willing to offer good valuations and enable companies to raise primary capital without the burden of going public is becoming more common," said Daniel Simons, ECM partner at law firm Hogan Lovells.

DELAYED DECISIONS

Firms still intent on going public are watching and waiting.

Volkswagen (DE:VOWG_p) on March 13 halted preparations for the IPO of its trucks unit Traton until market conditions improve.

Activity is expected to slowly improve throughout the year and is likely to be led by the buoyant payments sector.

Italy's Nexi is expected to list next month in one of the biggest flotations of the year, while Dubai-based payment firm Network International is set to be the first international company to list in London this year.

Elsewhere, South Africa's media and internet giant Naspers is planning a bumper listing in Amsterdam with the spin-off of its international e-commerce ventures including its one third stake in China's Tencent.