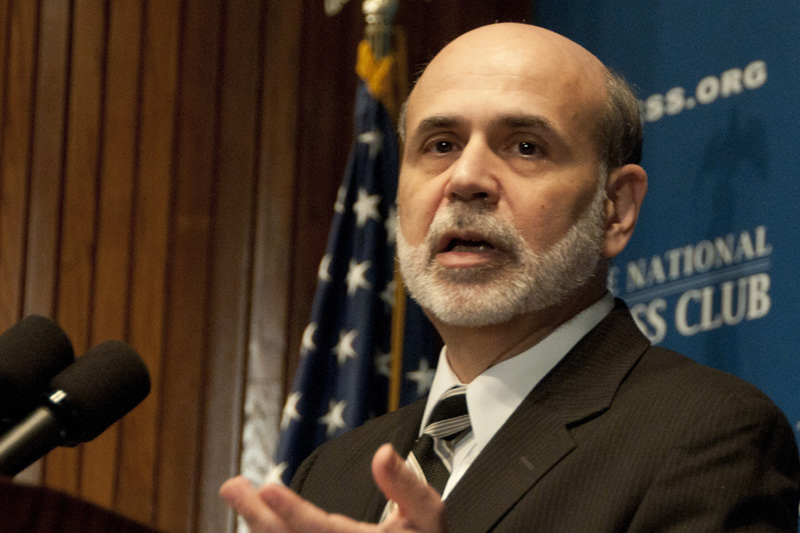

Investing.com - European stock markets turned higher into the close Tuesday as sentiment was lifted when Fed Chairman Ben Bernanke stated that the U.S. fiscal cliff fix may bring a very good year for equities.

However, Sentiment was hit earlier after Moody’s stripped France of its prized AAA credit rating late Monday.

At the close of European trade, the EURO STOXX 50 gained 0.58%, France’s CAC 40 soared 0.65%, while Germany’s DAX 30 added 0.69%.

Lifting sentiment, Ben Bernanke stated that an agreement was very close to reduce long term Federal Budget deficits.

He went on to say that the solving of the fiscal cliff dilemma may result in a very good year.

The eurogroup of euro zone finance ministers was to hold talks in Brussels later in the day to discuss whether Greece can receive its next tranche of bailout funds.

Meanwhile, ratings agency Moody’s downgraded France’s AAA-rating by one notch to AA1 late Monday and kept a negative outlook on the rating, citing weakening growth prospects for the euro zone’s second-largest economy.

The downgrade followed a similar move by Standard & Poor’s several months ago, leaving Fitch Ratings as the only ratings firm to keep France at triple-A.

Shares in the financial sector remained lower, with France’s BNP Paribas and Societe Generale down 1.2% and 0.75% respectively, while Germany’s Deutsche Bank and Commerzbank fell 3.1% and 2.3% respectively.

Peripheral lenders also remained under pressure, with Italy’s Intesa Sanpaolo retreating 1.9% and Spain’s BBVA down 1.2%.

Swiss investment bank Credit Suisse lost 3.3% after saying it would reorganize its business to form a new wealth-management division.

Elsewhere, in London, the FTSE 100 gained 0.18%, despite losses in lenders. HSBC shares declined 1.45%, Royal Bank of Scotland dropped 2.1% and Barclays slumped 2.75%.

On the upside, commodity trading house Glencore rose 1.85% after shareholders approved the firm’s proposed all-share merger with copper miner Xstrata. Xstrata shares added 2% on the news.

However, the U.S. markets are trading lower with the Dow Jones off 0.23%, the S&P 500 lower by 0.02% and the Nasdaq down 0.28%

Investors are awaiting the U.S. initial jobless claims on Wednesday.