By Liana B. Baker

(Reuters) - Hedge fund Elliott Management Corp's attempt to acquire U.S. networking software maker Gigamon Inc has ground to a halt over price disagreements, people familiar with the matter said on Thursday.

The development is a setback for Elliott's private equity arm, Evergreen Coast Capital Partners, as it seeks to become a credible buyer of public companies. Elliott has participated in buyouts of smaller private companies such as Dell's software group but it is best known as an activist shareholder.

Gigamon rejected Elliott's latest offer in the past few weeks after it came in below the company's share price, one of the sources said. Gigamon shares ended trading on Thursday at $43.55, giving the company a market capitalization of $1.6 billion.

Negotiations could resume in the future with Elliott, or Gigamon could receive an offer from another party, the sources said.

The sources asked not to be identified because the matter is confidential. Elliott and Gigamon declined to comment.

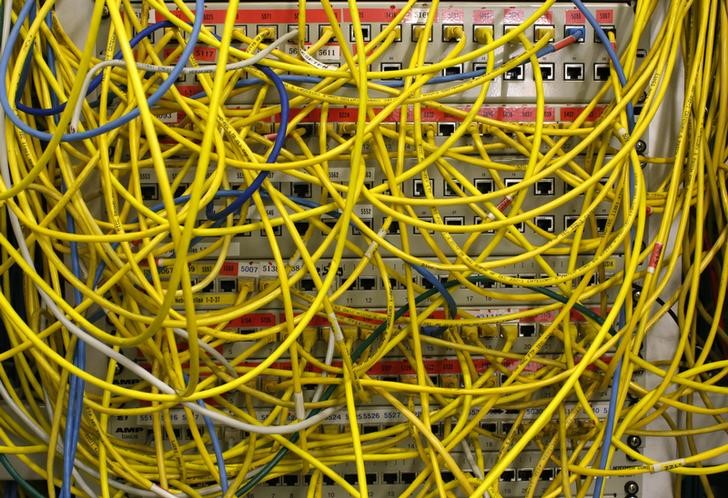

Santa Clara, California-based Gigamon makes software used in large data centers to boost the flow of traffic and prevent bottlenecks.

Elliott is one of Gigamon's largest shareholders, having disclosed a 15.3 percent stake in the company in May. Gigamon shares have risen about 24 percent since then.

Founded by billionaire Paul Singer, Elliott is known for pushing many technology companies to sell themselves in recent years, including Mentor Graphics, LifeLock Inc and Qlik Technologies. But it has branched into private equity investing through its Evergreen unit, which was set up in 2015 and announced its first deal last year.

A leveraged buyout of Gigamon would mark the first takeover of a public company to be led by Elliott.

Elliott's Evergreen participated in the auction for LifeLock, but the company was ultimately sold to Symantec Corp (NASDAQ:SYMC) for $2.3 billion.