By James Regan

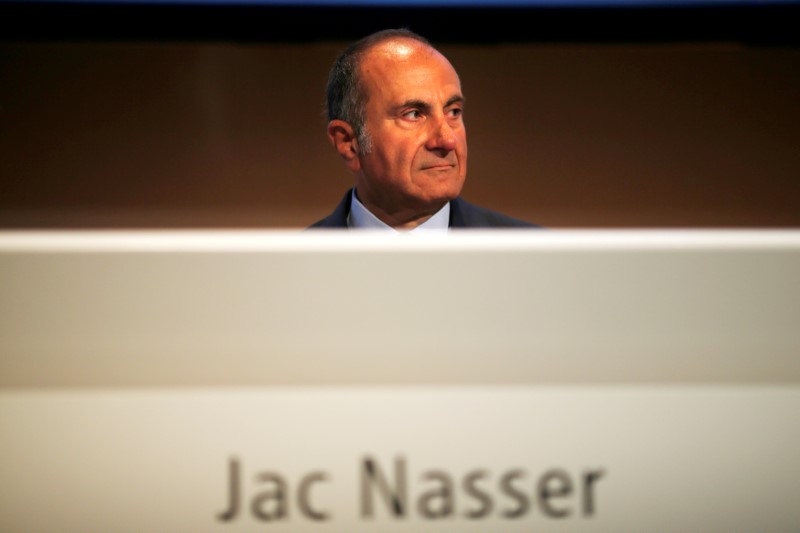

SYDNEY (Reuters) - Elliott Management is willing to back a board member of BHP Billiton (AX:BHP) (L:BLT) to be its chairman upon the retirement of Jac Nasser despite deep reservations about its top management, a source close to the activist shareholder said on Thursday.

Elliott, founded by billionaire Paul Singer, is pushing for a $46 billion overhaul at BHP that includes spin offs, dismantling a corporate structure built on dual listings in London and Sydney and returning more money to shareholders. The Anglo-Australian miner has rejected the demands.

The activist investor blames Nasser and BHP's top management for what it sees as bad investments by the world's biggest mining house, particularly in U.S. shale gas, the source said.

But Elliott believes "there are personalities on the board that are talented and capable", with the "potential for someone to be selected from the existing board", the source said.

It is unclear what impact Elliott's backing or opposition to a particular candidate will have on the chairman's appointment.

Elliott has been meeting with major BHP shareholders since going public with its restructuring proposals on April 10 to gauge support for change at the company.

Australian media have reported that Westpac Bank (AX:WBC) chairman Lindsay Maxsted, former investment banker Carolyn Hewson, Orica (AX:ORI) chairman Malcolm Broomhead and former Origin Energy (AX:ORG) managing director Grant King are among the potential frontrunners to succeed Nasser.

The source declined to name any preferred candidates from inside BHP, saying this could be "the kiss of death" for their chances.

BHP has not commented on the potential candidates for succession. It did not immediately comment when contacted on Thursday about the source's observations on Elliott.

Elliott holds just over 4 percent of the London-listed shares, short of the 5 percent needed to call a shareholders' meeting.

Nasser, a former chief executive of Ford Motor Co (N:F) who has led BHP’s board since 2010, has labeled Elliott's plan "flawed." He announced in September he would not seek re-election at the next shareholders' meeting.

Sydney-based Tribeca Investment Partners last week became the second BHP shareholder to push publicly for changes, calling for an overhaul of its board and for Chief Executive Andrew Mackenzie to be fired.

Elliott says adopting its approach could unlock as much as $46 billion in additional value for BHP shareholders. Demerging BHP’s U.S. petroleum business could release up to $15 billion, it says, with share buybacks and the use of tax credits to deliver the rest.

"If you look at this trend of under performance over the past seven or eight years, it does correlate fairly well with the chairman, the CEO and the CFO," the source said. "This is not to say they are the entire reason, but leadership starts and ends at the top."

The source said Elliott was unlikely to initiate legal action anytime soon against the current board over perceived deficiencies in their management, despite the company's long history of courtroom battles with adversaries, choosing instead to win over BHP shareholders to its strategy.