(Bloomberg) -- Terms of Trade is a coming daily newsletter that untangles a world embroiled in trade wars. Sign up here.

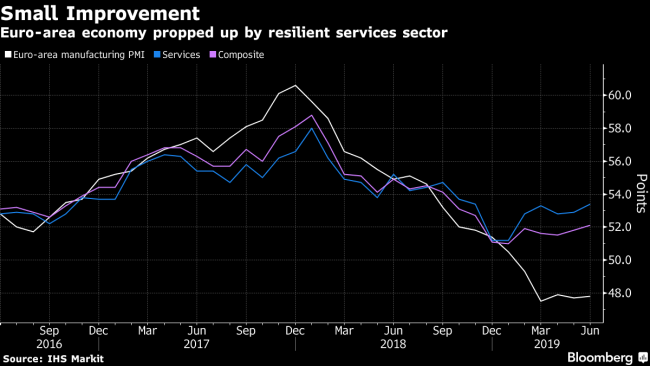

Europe’s economy showed signs of stabilizing at the end of the second quarter, but weak sentiment will keep policy makers on edge about the outlook for the rest of the year.

Days after European Central Bank President Mario Draghi made it clear the ECB is poised to cut interest rates or re-launch asset purchases if the region’s economic outlook doesn’t improve, the monthly Purchasing Managers Index showed a pickup in activity, rising to a seven-month high. German bonds declined and the euro rose.

It’s a “hint that the worst of the current slowdown may be behind,” said Chris Williamson, chief business economist at IHS Markit, which compiles the PMI.

The mood was tempered by the fact that expansion remains lackluster, price growth is subdued and executive optimism in the outlook is the lowest in almost five years. Uncertainty about trade and geopolitics is weighing heavily on sentiment, and a continued drop could drag on investment and hiring in the euro area. An ECB paper this week said that “confidence shocks” have had a negative effect on investment this year.

The report also showed that manufacturing -- led by Germany -- continues to contract and remains the region’s weak spot, while services are a pillar of stability. Policy makers are closely watching the divergence between the two sectors, and the worry is that the weakness will spread.

What Bloomberg’s Economists Say...

“The European Central Bank will welcome the composite PMI survey reading for June. It signals that GDP growth was stable in the second quarter and the service sector remained relatively immune to the weakness in manufacturing. Today’s report does little to increase the chances of monetary easing.”

--David Powell, European EconomistClick here to read the full REACT

Germany manufacturing contracted for a fifth month in June, though Markit noted “tentative signs” that the worst has passed. Europe’s largest economy has suffered in particular from weaker car sales, as well as a drop in semiconductor demand. Siltronic AG this week cut its full-year sales forecast, citing “geopolitical uncertainties” and the impact of U.S. export restrictions against Chinese technology firms.

In France, both the manufacturing and services readings performed better than forecast in June.

German 10-year yields rose slightly on Friday and were at -0.296% as of 11:10 a.m. Frankfurt time. They’ve been below zero since early May, pushed lower by a weaker global backdrop and the prospect of more monetary easing.

“For the ECB, this PMI will surely have come as an encouraging sign, but as manufacturing weakness remains significant, it is unlikely to impact the state of high alert in Frankfurt,” said Bert Colijn, an economist at ING in Amsterdam.