(Bloomberg) -- Investors preparing for an era of higher volatility may want to take a pause: A sustained period of price swings isn’t in the cards quite yet.

Changes in volatility measures may only be short-term reactions rather than a wholesale regime shift, offering a potential tonic to traders who have been on edge since inflation data punched up turbulence in late January. That handed global stocks their worst month since 2016, while U.S. 10-year yields marched to the highest in four years.

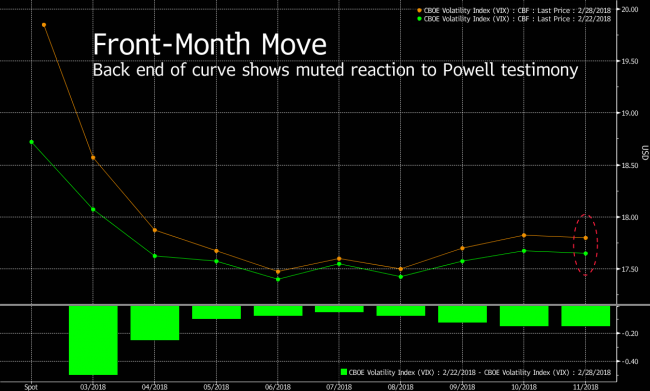

Yet equity and Treasury volatility markets show few signs of unabated fear. The move in the Cboe Volatility index futures curve has been contained to the front end for the most part, suggesting muted expectations for choppy equity conditions further out. U.S. government bonds tell a similar story.

Meanwhile, appetite for longer-dated paper may reemerge. Add to that spotty economic data suggesting a peak in the inflation recovery story, and the threats that could move us into a pocket of higher volatility have receded, according to Michael Purves, global chief strategist at Weeden & Co.

“The volatility surface continues to normalize,” Purves wrote in a Wednesday note. “This presumed rate/volatility regime shift is a much more gradual process than one might have expected.”

Market Mayhem

During February’s turmoil, front-month futures for the VIX jumped 38 percent while the back end advanced 9.7 percent. Of course, that difference is to be expected during sharp selloffs, as investors price in current market mayhem versus the less-known environment of the future.

Yet after the turmoil subsided, increased volatility still mainly showed up in the front end of the curve. Even following Federal Reserve chair Jerome Powell’s testimony to Congress this week, front-month futures gained 12 percent compared with 2.9 percent for the longer-dated contracts, as traders priced in less impact from his hawkishness down the road.

Not everyone is convinced the threat of a sustained shift to higher volatility has passed. The ultra-low regime is already behind us, according to Societe Generale.

“The Fed is more tolerant of market volatility, and central bank balance sheets are gradually becoming lighter,” derivatives strategists at the bank headed by Jitesh Kumar wrote in a Wednesday note. “Hence, options market flow could move further away from the kind of short vol carry trade that flourished in the recent past, which have been fueling the depressed volatility environment.”

Bears and Bids

One of the biggest catalysts for increased turbulence is continued pain in the U.S. bond market. But yields may not stay elevated for much longer, if history is a guide. Positioning in longer-dated paper shows extreme bearishness -- in the past, that has been followed by a bid for the 10-year.

Last month, investors held the most net short contracts on 10-year futures in nearly a year, and have already slightly reduced their short exposure, CFTC data show.

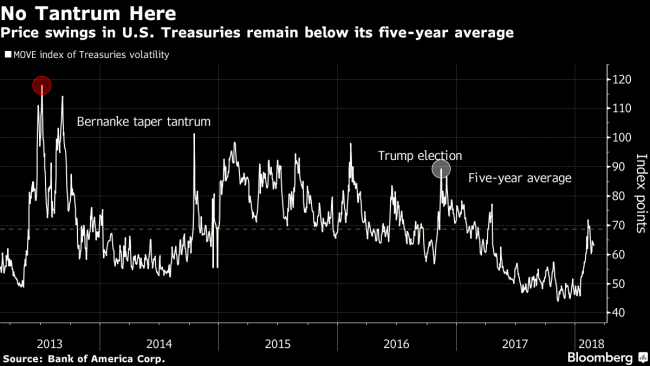

The uptick in volatility in the interest-rate market is also modest compared with the panic over higher U.S. yields in the aftermath of the 2016 election or the Taper Tantrum of 2013. A gauge of price swings in the Treasury market has risen by 16 points this year to 63 -- still below its five-year average of 68.6.

Investors may be reacting to economic indicators that suggest the worst inflation scares are behind us, said Purves.

“Forward inflation has consolidated its move higher, but has failed to accelerate while the Citi economic and inflation surprise indices continue to trend downwards,” he wrote. “Weaker than expected CPI prints in Europe and the weaker China PMI’s confirm that the global growth/global inflation recovery story may well have peaked for the time being.”