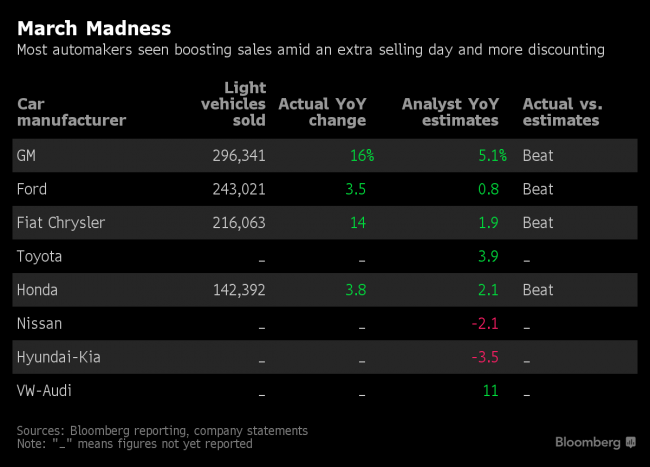

(Bloomberg) -- Fiat Chrysler Automobiles NV (NYSE:FCAU), General Motors Co (NYSE:GM). and Ford Motor Co . (NYSE:F) all reported a bigger-than-expected bump in March sales as more aggressive industry discounting gave carmakers a boost.

GM said its March sales surged 16 percent, triple the gain analysts had been expecting. Ford’s light-vehicle sales rose 3.5 percent, outpacing the 0.8 percent gain analysts had been forecasting.

“March represented a strong start to the spring selling season for both Ford and the industry,” Mark LaNeve, U.S. sales chief at Ford, said in a statement.

Fiat Chrysler boosted car and light truck deliveries by 14 percent, beating analysts’ average estimate for a 1.9 percent increase. Sales for the Jeep sport utility vehicle brand soared 45 percent, driven by a more than six-fold surge for the compact Compass.

Most automakers were expected to report small increases for March, which had one more selling day than the year-earlier month. The annualized pace of sales, adjusted for seasonal trends, was probably about 16.8 million vehicles. That would match the rate in March 2017 and would be the weakest since Hurricane Harvey ravaged dealerships across the Texas Gulf Coast in August.

“Healthy first-quarter numbers indicate the industry is on solid ground, but that doesn’t mean we can expect another banner year for new car sales,” Jessica Caldwell, Edmunds executive director of industry analysis, said in a statement. “We could potentially see sales start to tumble in the high-volume summer months when shoppers aren’t seeing the deals they are looking for.”

Ford sales rose more than expected on a surge in deliveries of F-Series pickups and an 8.7 percent rise in sales to fleet buyers, such as daily rental companies.

GM is throwing a wrench in the industry sales reporting process by announcing a plan to end a 25-year-long practice of disclosing monthly results and shifting to quarterly releases. Kurt McNeil, U.S. vice president of sales operations, said the move will better separate “real” demand trends from “short-term fluctuations.”

The switch by GM comes as analysts widely expect industrywide deliveries to slump for the second year in a row after an unprecedented seven-year growth spurt. March may have been the first month this year that retail sales rose from a year earlier, according to Thomas King, senior vice president of data and analytics at J.D. Power.

“While this breaks a streak of three consecutive months of decline, the industry is boosted by a quirk in the calendar due to an additional selling weekend,” he said.

Incentive spending likely helped buoy sales last month, with average discounts rising $74 from a year ago to $3,849, J.D. Power said. That was driven by deeper discounting on trucks and SUVs -- up $160 per vehicle from a year ago -- in an increasingly crowded market.

“We will be watching the pickup truck segment carefully in March, as the new full-size Ram pickup has gone on sale while the new Chevrolet truck has not,” Rebecca Lindland, executive analyst for Kelley Blue Book, said in a statement. “There is strong brand loyalty in this segment and lots of interest in new product, so it will be telling to see how Chevy manages the transition to the new truck. Also, we know Ford is using aggressive incentives to defend their leadership position.”