Investing.com - Stocks launched at the end of the session today, unlike the SpaceX mission everyone was looking at postmarket.

Tomorrow brings unemployment numbers and those on long-lasting goods. And there will be the latest on oil stockpiles.

Here are the three things that could move the markets tomorrow.

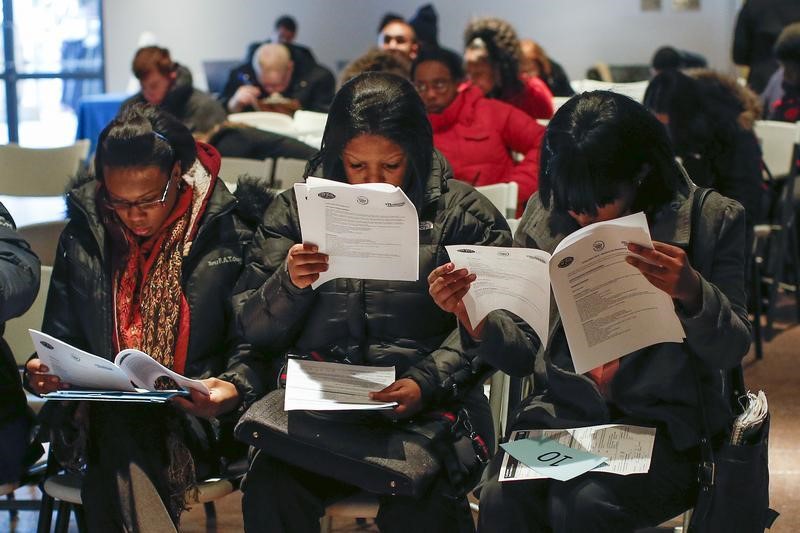

1. New Claims in a Plateau?

Economists expect more than 2 million more people applied for unemployment benefits last week.

The Labor Department issues the claims numbers at 8:30 AM ET (12:30 GMT) as usual.

The consensus forecast compiled by Investing.com of 2.1 million looks to be a pause for the market, even thoug the number is still incredibly high. But it’s also important to look at the level of continuing claims as the U.S. starts to reopen.

Those claims are expected to edge up to 25.75 million.

GDP numbers arrive at the same time, with the second measure of first-quarter growth expected to remain at a contraction of 4.8%. No surprise there.

2. Housing Data Arrive

Those familiar with domesticity will enjoy another duo of data tomorrow.

New home sales shocked everyone this week with a surprise gain and pending home sales for April arrive at 10:00 AM ET (14:00 GMT).

The number of homes under contract are expected to have dropped 15% last month, compared with a decline of more than 20%, according to forecasts compiled by Investing.com.

Those homes will need appliances as well, so check out durable goods orders at 8:30 AM ET.

Orders for goods lasting three or more years are seen plunging 19% for April.

3. Oil Inventories on Tap

Oil prices continue to bounce and tomorrow brings the official U.S. petroleum inventory numbers at 10:30 PM ET (14:30 GMT).

On average, analysts expect that U.S. oil inventories fell by about 1.9 million barrels for the week ended May 22, according to forecasts compiled by Investing.com.

After the bell today the American Petroleum Institute said its measure of weekly stockpiles jumped by 8.7 million barrels.