By Edward Taylor

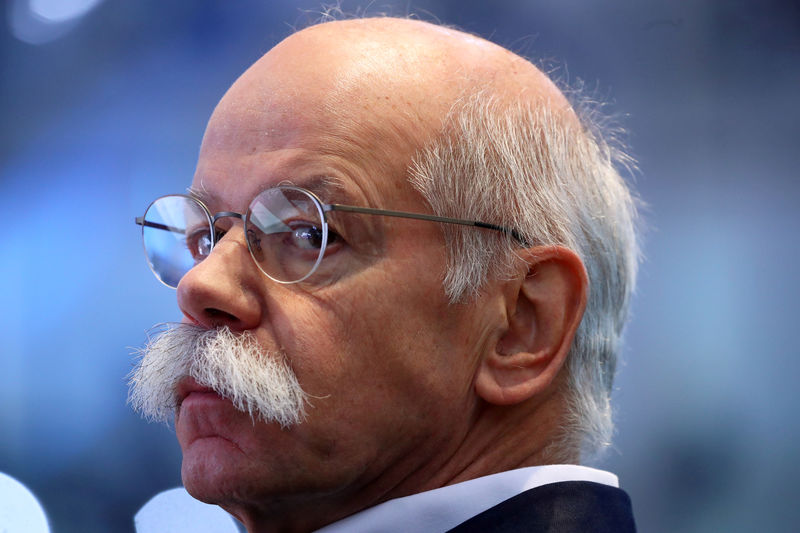

OSLO (Reuters) - Daimler's next chief executive will have a tough job to restore margins at Mercedes-Benz, current boss Dieter Zetsche told Reuters on Wednesday, as Mercedes-Benz launched a new luxury electric car to rival Tesla (NASDAQ:TSLA).

Zetsche, who bows out as CEO on May 22, said the German luxury carmaker needed to find a way to rebuild margins after research and development (R&D) costs at Mercedes-Benz ballooned.

"There are many challenges ahead. We are in a situation of an economic slowdown. It is not going to be easier going forward," he said on the sidelines of the launch event near Oslo.

Pressure to develop electric and autonomous cars has led R&D costs at Mercedes-Benz passenger cars to rise to 14 billion euros ($15.7 billion) from around 8 billion euros four years ago, Zetsche said.

At the same time, China, the world's largest car market, has seen sales momentum slowing for nine months in a row, with a 5.2 percent fall in sales in March.

Mercedes-Benz's large electric car will hit showrooms this summer, years after Tesla launched its Model S in 2012.

Daimler has been cautious about embracing mass production of electric vehicles at Mercedes-Benz amid concerns about operating range and customer acceptance.

The company took a 9.1 percent stake in Tesla for around $50 million in May 2009 to learn about battery technology, but sold its stake for a $780 million profit in 2014.

Daimler launched an electric car under the smart brand in 2010, but waited until 2014 to build an electric Mercedes-Benz B-Class.

Daimler, like other manufacturers, has struggled to make electric cars profitable, although the cost of battery packs is expected to fall as they invest in ramping up battery cell production.

ING analysts say the total cost of ownership, including fuel prices, could reach parity between electric and combustion engined vehicles by 2025.

In an effort to make a profit with electric cars, Daimler has opted to manufacture the Mercedes EQC in a way that enables it to be built on the same production line as a combustion engined car, retooling existing plants.

Daimler is investing more than 10 billion euros to expand the electric EQ model range and is building battery cell production facilities.

The Mercedes EQC will have an operating range of 445-471 kms, with a base version costing below 60,000 euros to make it eligible for Germany’s electric car environmental bonus.

Asked whether Daimler was too late to the electric vehicle trend, Zetsche said: "For the past 40 years I have heard that German manufacturers have missed all the important trends. But apparently customers still like cars from manufacturers that have missed the boat."

Zetsche took over as CEO of DaimlerChrysler in 2006 and took the decision to sell Chrysler, returning Mercedes to the top selling luxury brand globally in 2016 and defending the title ever since.

Zetsche said Daimler's future hinged on making electric cars profitably.

"We need to prove that we can earn adequate margins, and the capital market wants to proof points. We are working on making this a reality."