By Karen Pierog

CHICAGO (Reuters) - The heat is on for Illinois lawmakers to address the state's financial problems in a fiscal 2019 budget that faces a May 31 deadline for passage with a simple-majority vote, credit rating analysts said on Friday.

Illinois' general obligation (GO) bond ratings, the lowest among the 50 states, are just a notch or two above the junk level, reflecting a huge unfunded pension liability, escalating pension contributions and a chronic budget deficit.

"The question is what progress will the state make, if any, in breaking out of those long-running challenges?" Moody's Investors Service analyst Ted Hampton said in a phone interview. He added that the outcome of the budget process will be more significant than when the process ends.

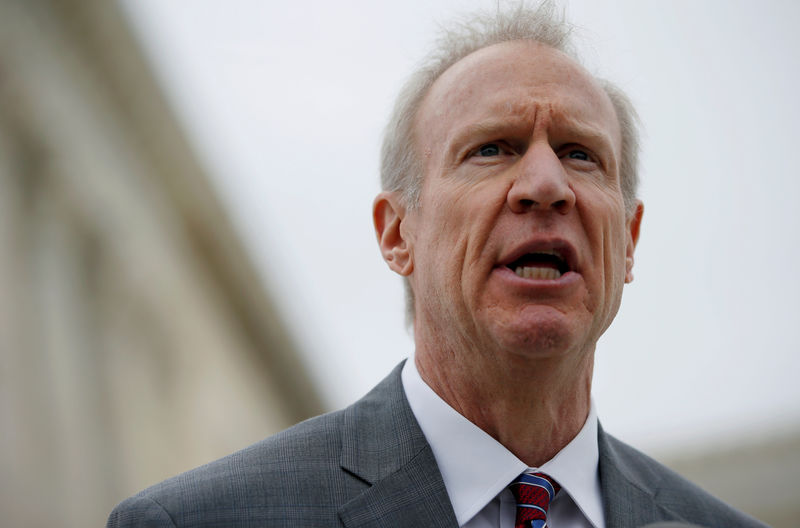

An impasse between Republican Governor Bruce Rauner and Democrats who control the legislature left the nation's fifth-largest state without complete budgets for an unprecedented two-straight fiscal years. Lawmakers enacted a fiscal 2018 budget and income tax rate hikes over Rauner's vetoes in July, sparing Illinois from becoming the first state with a junk rating.

"Nobody sees the advantage of creating another impasse," said Steve Brown, spokesman for House Speaker Michael Madigan.

Rauner, who proposed a $37.6 billion general fund budget in February, has been meeting with legislative leaders to try to reach a deal on a spending plan for the fiscal year that begins July 1.

But details are scarce.

"Rank and file members have no idea what the budget is going to look like," State Representative Jeanne Ives, who narrowly lost the March Republican primary for governor against Rauner, said during Friday's House session.

Prospects for tackling the state's $129 billion unfunded pension liability appear to be slim given bipartisan opposition in the House to Rauner's proposal to shift some pension costs onto school districts.

Constitutional concerns are also clouding chances for legislation Rauner wants to reduce pension costs by giving workers a choice of counting future raises they may receive toward their pensions or receiving retirement payments that include a 3 percent annual cost-of-living increase.

Fitch Ratings analyst Eric Kim said a return to political gridlock that fuels fiscal pressures could trigger a negative rating action for Illinois' GO debt.

Using recently revised criteria, Fitch on Friday downgraded by five notches the rating on $2.5 billion of Build Illinois sales tax revenue bonds to A-minus. The firm cited too big a spread between the debt's previous AA-plus rating and the state's GO rating of BBB with a negative outlook.

Meanwhile, Illinois' so-called credit spread for 10-year bonds over Municipal Market Data's benchmark triple-A yield scale narrowed in recent days to 190 basis points, signaling easing concerns by investors over the state's debt.

(Graphic: Illinois credit spread January-May 24 - https://reut.rs/2KVG25c)