By Jesse Cohen

Investing.com - Tesla (NASDAQ:TSLA) shares tumbled 17% on Wednesday, derailing a historic rally after a senior executive said the coronavirus outbreak would delay deliveries of its Model 3 cars initially scheduled for early February.

Tesla (NASDAQ:TSLA) stock down was down as much as 20% during intraday trading Wednesday, which would have been its worst day in history.

Share are off another 5% on Thursday, taking the stock below the $700-level.

The huge falls come after two spectacular days for the stock earlier this week.

Tesla (NASDAQ:TSLA) shares were up nearly 20% on Monday, which was its biggest one-day jump since May 2013, and another 13.7% on Tuesday. The stock had soared as much as 23% Tuesday, hitting an intraday record of $968.99 per share.

The electric vehicle maker’s market cap stands at $132.4 billion.

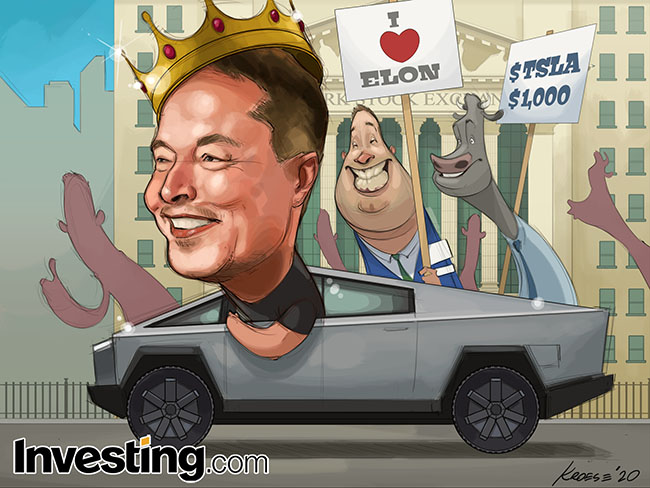

Tesla's rally of over 300% since early June has been a vindication for Chief Executive Elon Musk, who has transformed a niche car maker with production problems into the global leader in electric vehicles, with U.S. and Chinese factories.

Still, many investors remain skeptical that Tesla (NASDAQ:TSLA) can consistently deliver profit, cash flow and growth in the face of competition from established rivals.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report